As you saw in last month’s update of the EW Electrical Pyramid, there are all sorts of alternative channels that electrical manufacturers can use to sell electrical products to the market. It’s tough to put an exact number on just how many brick-and-mortar locations all of these other sources of supply in the EW Electrical Pyramid have.

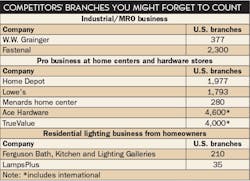

But the chart below offers some insight into just how many locations the largest of these alternative channels operate. I don’t think any one electrical manufacturer uses all of these channels, and I would be surprised if any one distributor competes against all of these channels. But that’s the beauty of the EW Electrical Pyramid and the reality of the electrical marketplace — your view of it changes depending on your own unique market interests.

Along with these 15,572 brick-and-mortar locations that the companies in the chart operate, you must consider how many website inquiries they may get from your customers. And don’t forget to add in web-only competitors like Amazon for Business, www.1001bulbs.com and www.automationdirect.com that are miles ahead of most electrical distributors in their online efforts.

And if you have any exposure internationally, you also have to consider the fact that most of the companies in the chart have sizeable operations outside the United States. For instance, W.W. Grainger has 188 locations in Canada and Fastenal has about 300 locations internationally.

The home centers and large hardware retailers are even more internationally oriented, as Home Depot has 292 stores outside the U.S; Lowe’s has 37 stores in Canada and 10 in Mexico; Ace Hardware operates in 70 countries; TrueValue targets 58 nations; and Ferguson has 222 branches in Canada.

What does all this mean for electrical distributors? More than anything else, the most important lesson they can learn from Electrical Wholesaling’s Electrical Pyramid published in last month’s issue and the additional analysis in this issue’s “A Closer Look at the Electrical Pyramid” (p. 19) is the importance of doing a regular 360-degree analysis of all possible competitors in local markets who are going after the full breadth of the traditional electrical market — as well as those companies just targeting certain products or customer groups.