The economic expansion has ignited a flame below the electrical construction market, sparking an explosion of opportunities for the nation’s Top 50 electrical contractors.

“When the market appeared to be recovered, our clients held on as long as they could,” says John Boncher, president and CEO of Cupertino Electric, Inc. (No. 7), San Jose, Calif. “Once they realized that the recovery was real, they released the hounds, and there was a building explosion.”

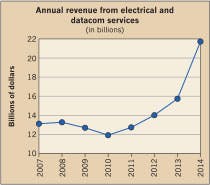

As such, many markets took off like a bullet. In turn, the total electrical and datacom revenue number for the nation’s largest electrical contractors jumped from $15.7 million in 2013 to $21.8 million in 2014 (Fig. 1).

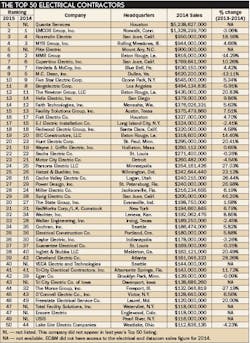

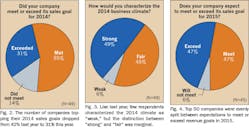

Ten companies on EC&M’s annual Top 50 Electrical Contractors List on page 19 posted at least a 15% increase in revenues. In addition, 31% exceeded their sales goal, and 55% met their revenue objectives (Fig. 2).

For example, Sprig Electric (No. 29), San Jose, Calif., scaled nine spots in the listing this year when $20 million of work from two years ago spilled over into last year. The contractor was both stressed and humbled about exceeding its targeted growth rate of 10% to 15%, says Mike Jurewicz, COO.

“We are humbled that our customers have confidence in Sprig, and we’re grateful for our employees who teamed up to successfully complete every project on time,” Jurewicz says. “Posting a 46% revenue gain was never intended. It became a new challenge that the organization had no choice but to manage.”

Like one-third of the Top 50, Sprig was able to adjust its bids for greater profits in 2014. A portion of its expected profit improvement, however, was eroded by two factors — the financial impact of California’s latest Title 24 energy efficiency standards and the expense of hiring and training new employees to handle the increased workload.

“With a strong market, one would assume it’s a seller’s market, which is true for rental and real estate prices,” Jurewicz says. “Electrical bid margins have improved, but only from downright stupid to almost reasonable. We are looking forward to a continued shift in bid margins — to reasonable or even to healthy.”

Roughly two-thirds of the companies (65%) realized about the same profit margins as the year before, while about 57% of the contractors expect their 2015 profits to remain close to 2014 levels.

“The market has improved, but there are still many bidders on projects, which, in turn, keeps margins lower than they were prior to the economic downturn,” says Doug Mertzlufft, president of Guarantee Electrical Co. (No. 37), St. Louis.

Fourteen of the Top 50 posted a decline in revenues, including E-J Electric. Bob Mann, chairman of E-J Electric Installation Co. (No. 17), Long Island City, N.Y., attributed the slight drop in sales to increased competition, including that from smaller contractors.

“There is more and more competition coming into the field,” Mann says. “They are going after the jobs that they never thought that they would be able to pursue, handle, or manage.”

Business climate. Across the country, the nation’s Top 50 contractors were nearly equally split between working in what they characterized as a “fair” and “strong” business climate (Fig. 3). Only three respondents considered the market to be weak last year.

On both the East and West Coasts, contractors reported that activity ramped up to unprecedented levels. For example, Cupertino Electric posted a 10.3% increase due to the booming geographical markets in the western United States.

“There are twice as many towers and cranes in San Francisco than ever before, according to the building department,” Boncher says. “The market there is going extremely crazy. Also, I have not seen Silicon Valley this busy ever before.”

The high-tech market is driving the Bay Area business climate, and he doesn’t see this area slowing down, says Jurewicz of Sprig Electric.

“High-tech is not just gaining speed — it’s sprinting at a furious pace,” Jurewicz says. “San Francisco has joined the Silicon Valley in attracting tech’s brightest along with their big dollar IPOs who are hoping to be gobbled up at premium prices by the tech titans.”

On the East Coast, strength is also returning to the construction market, Mann says. For example, in New York City, overseas investors are pouring funds into the construction of high-rise towers on “Billionaire Row,” in midtown Manhattan, where a single apartment can run between $25 million to $95 million. Mann is seeing a surge in construction across the board from transit to health care to stadium work.

“The economy has come back terrifically for the first time in ages, and it has helped the construction industry to return,” Mann says.

To handle all of these new work opportunities, a few of the Top 50 opened up new branch offices, including Sprig Electric, which created an East Bay office 30 miles east of Oakland, Calif.

“It’s so much more affordable, and now our employees can go to an office without having a two-hour commute,” Jurewicz says.

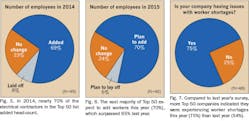

Contractors not only expanded geographically, but also internally. To handle the increased workload, 69% of the companies hired more employees last year (Fig. 5), and 70% plan to increase their staffing levels this year (Fig. 6). In contrast, only 8% of the companies laid off employees in 2014, and a mere 6% plan to reduce headcount this year.

Contractors from coast to coast are hiring more employees to handle the rapid growth. For example, Pike Electric (No. 5), Mount Airy, N.C., hopes to add close to 1,000 field positions in the future. With local talent tapped, however, the company expects to face challenges when it comes to recruitment and retention due to the competitive environment.

Other contractors are also boosting staffing levels, including USIS (No. 49), Pearl River, N.Y., which has hired about 200 new employees over the last three years. In addition, Parsons Electric (No. 24), Minneapolis, brought 147 new field and office employees on board, and E-J Electric hired more employees to work in the field and on its engineering, project management, and estimating teams.

On the West Coast, Cupertino Electric is actively searching for employees to work in various offices in Northern and Southern California.

“All those regions are booming, and we have a shortage of every single type of employee,” Boncher says. “There is far more work in front of us right now than we have people to build it. Everyone is scrambling for people and fishing from the same pond, and it’s very competitive.”

As the Top 50 look to increase their field and office workforce, they are facing a stumbling block — veteran workers are retiring, and not enough skilled workers are filling their work boots. In fact, 75% of the Top 50 say they are facing a labor shortage (Fig. 7), and the most difficult positions to fill include foremen, project managers, job superintendents, and journeymen.

The labor shortage stems from the fact that during the last recession, the industry eliminated a lot of jobs, and schools closed many entry-level programs, says Joel Moryn, president of Parsons Electric. To recruit new employees, Parsons has executed successful internship and entry-level project engineer programs.

“We kept our training programs going, and we developed some robust training tools, but the demand is high enough now that we still aren’t doing enough,” Moryn says.

To battle the labor shortage, contractors are employing a number of different approaches. For example, Guarantee Electric is engaging outside resources, compensating employees for referrals, and training field personnel to move up into leadership positions. Meanwhile, Sachs Electric (No. 22), St. Louis, is using social media and recruiters to find experienced personnel and is recruiting from universities for graduate engineers.

To build up its field workforce, USIS, a third-generation electrical contracting firm owned and operated by the Lagana family, created a comprehensive six-year apprenticeship training program. Jimmie Bodrato, vice president of electrical services, says by giving the electrical apprentices exposure to all aspects of its electrical contracting operation — from estimating in the office and pre-fabrication in the shop — they can become future leaders.

Strong markets. For the second year in a row, the general buildings category ranked as the top area of expertise for the nation’s Top 50.

“The electrical market is booming throughout the different sectors we work in,” Bodrato says. “Construction managers and general contractors can’t build buildings fast enough to keep up with demand.”

Drilling down further, other hot markets last year include health care, data center, private office, education/institution, power, and manufacturing. This year, the Top 50 players also expect the highest volume of projects to stem from these market sectors.

Within the health care market, Mann says his firm is seeing a resurgence of opportunities.

“Hospitals seem to be doing much better, and a lot of hospitals that went out of business are coming back — and coming back strong,” Mann says. “They are spending money to expand their facilities and compete with each other in their specialties.”

Across all Cupertino Electric’s different divisions, Boncher says he doesn’t have a single division not booming.

“There is a ramp-up in employees across all divisions, and every segment in our business is expanding,” Boncher says. “We have divisions for markets like renewable energy, transmission and distribution, and data centers — and all of them are very active right now.”

The data center market became a significant portion of the contractor’s business in the mid-1990s. While this market still has a significant amount of opportunity, Boncher says he is noticing a shift taking place.

“It’s an interesting paradox — a tremendous amount of data center builders are acting like the developers, and price is a major issue,” he says. “For that reason, the risk of the projects is outpacing the reward. It’s still my favorite segment, but at Cupertino Electric, we are definitely being selective and prudent about the projects we build.”

In addition to data center work, the power industry also ranked as one of the top markets for EC&M’s Top 50. This can be evidenced by the huge number ($5.2 billion in electrical revenue) posted by Quanta Services (No. 1). New to the Top 50 list this year, Quanta provides engineering, procurement, and construction services for comprehensive infrastructure needs in the power and oil and natural gas industries, a major portion of which is tied to the power sector. While this industry presents certain challenges — such as securing expensive heavy equipment and forging relationships with electric utilities — it also offers opportunities due to the aging infrastructure and need for emergency response and disaster recovery.

“While this market isn’t exploding like the other segments, it is slow and steady, and we enjoy working in this space,” Boncher says.

Within the power industry, Mann says high-voltage distribution and cogeneration remain hot markets. For example, E-J has a very active transmission and distribution operation, and its linemen work on maintenance and restoration projects.

Another market that is springing back is the office sector. When the economy spiraled into a downturn, companies began “right-sizing” their employees, and office expenditure was moved on to the backburner. Today, high-tech companies are constructing single-use corporate campuses with labs, data centers and office space.

“Companies waited, and waited, and waited — until they were almost in dire straits in regard to space,” Boncher says. “All of a sudden, the market was flooded with new builds for office space, and most, if not all, of the Silicon Valley occupants have built a new campus or a significant structure, or they are well underway with the design of projects.”

Prepping for future growth. By investing in the latest tools and technology, contractors can pump up the productivity of their field workforce, leading to higher sales down the line.

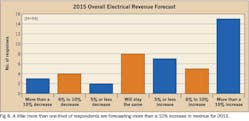

As the contractors forecast their sales for this year, an equal percentage of companies (47%) expects to meet or exceed their sales goals (Fig. 4). About one-third are forecasting more than a 10% increase in revenue for 2015 (Fig. 8) including Parsons Electric, which has a strong backlog in health care, sports and recreation, hospitality, and industrial-type projects and has achieved success through market diversification.

“We are also well into our lean construction journey, which has helped us to compete at a strong level,” Moryn says.

Cleveland Electric, which is active in the data center, pharmaceutical, and health care markets, anticipates revenues to stay about the same this year.

“We were busy last year and expect to remain that way going forward,” says John Cleveland, president.

Nine contractors anticipate a decrease in 2015 revenues. For example, Sach Electric attributes its expected decline to several large projects that have been secured but will be delayed into 2016 instead of 2015.

As 2015 winds down, however, many of the companies expect the markets to continue heating up, or — at the very least — not fizzle out. For example, Jurewicz expects Sprig Electric’s revenues to grow about 10%, and its current backlog supports this increase.

“Because we staffed up to service the projects we completed, we are well positioned to grow beyond last year’s revenue,” Jurewicz says.

Fischbach is a freelance writer and editor based in Overland Park, Kan. She can be reached at [email protected].