Sponsored

While electrical folks think of the electric vehicle market in terms of the sales opportunities for electrical products needed for the installation of commercial fast-charging stations or adding 240V circuits in homes for those overnight charges, other presenters and attendees at the Copper Development Association’s recent conference, EVs: Navigating the Road Ahead, conference had different interests in the market. Presenters at the CDA event included representatives from auto companies; state public transportation systems and other state agencies; the Southern Co. electric utility; and trade groups including the National Electrical Manufacturers Association (NEMA); Edison Electric Institute (EEI); Energy Storage Association, and the Alliance to Save Energy.

All had slightly different takes on how electric vehicle are impacting their interests in the energy market. Some panelists are most interested in the combination of public and private investment that will be necessary to build out a nationwide network of charging stations to support the millions of electric vehicles expected to hit the roads over the next few years. State officials had concerns about ensuring that the charging infrastructure would be installed in all areas of their cities, from low-income neighborhoods to high-rises.

Technologists on the panel expressed interest in seeing how and if owners of electric vehicles could make money by selling the unused electricity their batteries produce back to electric utilities and other power producers. One panelist used the example of fleets of electric school buses that sit dormant during the summer, but could generate electricity to be sold on the grid — producing an additional revenue stream for schools.

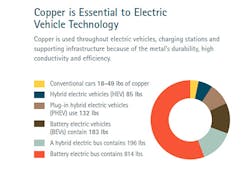

Because of its interest in new markets for copper, event sponsor Copper Development Association (CDA) is also a big believer in electric vehicles because of how much copper they require for motors, batteries, inverters, wires and charging stations. According to CDA data, a battery for an electric vehicle contains an estimated 183 lbs of copper, while the battery necessary to power an electric bus weighs in at 814 lbs.

The first session at the conference, held Dec. 11 in Washington, D.C., explored the various public policy decisions at the local, state and federal level that must be made to support and fund the installation of thousands of public charging stations across the nation. These charging stations will be needed to help get folks over their “range anxiety” (running out of charge before they find a charging station), and to attract the interest of the general public or commercial interests beyond the early adopters. Jason Hartke, president of the Alliance to Save Energy, said the scope of this build-out will need to be similar to the construction of the Interstate Highway System started by President Eisenhower in the 1950s.

The Electrify America initiative to install thousands of fast-chargers across the United States is impressive in its scope and potential. Wayne Killen, the Electrify America representative on the panel, said his group is in the process of installing 2,000 chargers at 484 stations around the United States. The 350 kW chargers being installed are capable of recharging an electric vehicle very quickly — providing 200 miles of vehicle driving range in just 10 minutes. That’s super-fast when compared to the overnight charging often required in residential installations that utilize Level 1 (120V) or Level 2 (240V) EV chargers. According to Electrify America’s website, its DC (direct current) Fast EV charging stations will be located along high-traffic corridors in 39 states, including two cross-country routes. “Locations will accommodate between four and ten chargers, with charging power levels up to 350kW available at every station, capable of adding 20 miles of range per minute to a vehicle,” it said. “Nationally, each planned station site will be located no more than 120 miles apart and, on key East and West Coast highways, planned locations average only 70 miles apart.”

Panelists tossed around a variety of estimates on just how much the EV market is expected to grow over the next few years. The Edison Electric Institute estimates that more than 1 million EVs are now on the road, and that by 2025 that number will grow to 8 million. While those numbers sound impressive, they still account for a small percentage of the 260 million-plus passenger cars registered in the United States through 2016, according to www.statistica.com, and most likely an equally small percentage of trucks, buses and other commercial vehicles.