Sponsored

Growth in the lighting market continues to outpace that of the overall electrical market according to a recent survey by Channel Marketing Group (CMG) that provides an interesting turn-of-the-year snapshot of electrical distributor, rep and manufacturer expectations for lighting in 2019.

CMG’s Pulse of the Lighting Market survey on performance in the fourth quarter of 2018 and the outlook for the year ahead, done in collaboration with financial services firm William Blair & Co., is the most recent of an ongoing quarterly series. The Q4 results showed that distributors, manufacturers and reps all see lighting market growth outpacing growth in the overall electrical wholesale channel’s sales and that they expect it to continue.

Several respondents, however, highlighted a growing volatility in the market. “Very unpredictable,” was one distributor’s assessment. “We have several large projects in but the bid activity is slow one week and busy the next.”

The survey gathered responses from 210 contacts in the electrical industry, 93 of them distributors and the remaining 117 manufacturer personnel or independent reps. The survey report included a host of anecdotal comments from respondents that add some detail and color to the discussion.

Strong Sales in Q4

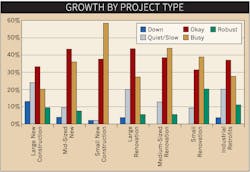

CMG’s study found that in the fourth quarter of 2018 the market was being driven by small to mid-sized projects, both new construction and renovation. Large new construction projects were reported to be slower than the previous quarter, though some reported being busy with large renovations, as seen in the graphic above.

Overall, distributors reported that their lighting sales were up, on a weighted average basis, by 7.25% and unit sales were up 7.44% in Q4 2018, a quarter characterized as “eventful” due to pricing changes attributed to tariffs and the disruption brought by the need to negotiate and implement the price changes. This exceeds the industry projection of total market sales by electrical industry economic forecasting service DISC Corp., www.disccorp.com, which forecast 5.8% for the quarter.

From the manufacturers’ perspective, sales in the quarter were looking even better, up 8.12% as an overall weighted average, with 25% of respondents expecting their sales to grow 5%-9% and 25% of the respondents reporting growth rates of 16% or more.

David Gordon, president of CMG, said in his report that some of the increase may be attributed to “forward buying” to get ahead of price increases and expected tariffs.

Independent manufacturers reps see growth beyond even the manufacturers’ estimates, projecting a 8.4% sales increase as a weighted average and an increase of 9.79% in unit terms in Q4. “This forecast is the strongest of the audiences and may be an indicator of the growth rate of Tier 2-3 lines, as these lines are most frequently handled by supply / NEMRA agents,” Gordon said, referring to rep agencies that belong to the National Electrical Manufacturers Representatives Association (NEMRA) in Portsmouth, NH.

As to the reasons behind the sales growth in the quarter, several distributors pointed to a growing understanding of the benefits of new lighting and control technologies among their customers.

“People are more interested in LED upgrades,” one distributor said. “Our guys are starting to put in more all-in-one LED solutions for projects. Slimlites, undercabinet strip and fluorescent replacement are where our numbers are coming from.”

The advances in lighting and control technologies also have produced some ongoing uncertainty that distributors look for help in resolving. One distributor’s team is seeing “more controls conversation, but the disconnect is there between manufacturers and industry adoption. Plus, in the industrial environment many have different controls on their process floors – more confusion.”

Distributors, manufacturers and reps all expect lighting to be a bright spot again in 2019. Distributors’ forecasts aggregated to expectations of 6.92% growth in lighting for the year ahead, again outpacing forecasts of overall electrical market sales growth by Electrical Wholesaling (6.1%) and DISC Corp. (3.5%).

Uncertainty Around Pricing and Tariffs

All the forecasts of lighting sales in the year ahead depend heavily on pricing levels, which are more difficult to foresee than is normally the case. Expectations of import tariffs on lighting equipment, components and materials have prompted a steady stream of questions among customers that highlight the unpredictability of the market, distributors said in their anecdotal comments.

“The unpredictable nature of the current pricing issues (tariffs) has created a lot of market uncertainty and apprehension,” said one distributor. “Some end-users are either canceling their projects or advancing them before the next price increase. There is a lot of market confusion as to WHY consumers are forced to pay more when this was meant to punish China.”

Of the distributor respondents to the survey, 30% said some projects have been stalled or canceled due to tariffs while 70% said the tariffs have had no impact. Although the direct impact of tariffs may be uneven, there was widespread agreement that the uncertainty the tariffs have caused is more general across the market.

A manufacturer raised an important question about the long-term impact of the tariff-based confusion. “The trade war is creating uncertainty in the marketplace and making it difficult to develop clear 2019 plans. When trade war ends, will China revert to being the low-cost producer, or will manufacturers remain with alternate supply chains they are developing now?”

In his presentation of the results, CMG’s Gordon proposed that many lighting manufacturers have used the “tariff opportunity” to implement across-the-board price increases. The survey showed that 37% of manufacturers increased pricing by 6% to 10% in the quarter but a number of Tier 2 and Tier 3 suppliers kept pricing steady, in some instances as a way to gain market share and in others as a chance to sell down existing inventory. Companies hope to retain some of this increase if tariffs are removed, Gordon said.

In the anecdotal comments, distributors reported that they have seen “Multiple price increases from the same manufacturer(s) in one quarter, unprecedented.”

One distributor noted that the increases have been uneven. “A large gap in ‘Tariff’ increase rates. Some are implementing very quick, some are holding off and gaining significant market share.”

The uncertainty created by the constantly changing news about the Administration’s position on the tariffs has created new challenges at the distributor level. “Very challenging to hold margins with factory price increases, although some have been put on a 90-day hold due to talks with China,” one distributor said.

Manufacturers, meanwhile, sounded notes of resounding agreement about the impact of price competition as the primary source of competitive challenges in the lighting market.

“Customers unwillingness to pay for any features continues to be the single biggest change and impact,” said one manufacturer. “There is optimism that the tariff related price increases will allow us to reverse the loss of price that has occurred over the last three years.”

A Changing Kaleidoscope of Suppliers

The other major trend highlighted in CMG’s report was an erosion in the dominant positions of the largest “Tier 1” manufacturing companies.

“The smaller manufacturers continue to become major players. They are no longer “2nd Tier” players in the market,” said one distributor.

“Mid-tier manufacturers still seem to outperform large manufacturers in both innovation and price,” said another.

Distributors were asked in the survey what percent of their business is done with a list of the “Top 7” lighting manufacturers: Acuity Brands, Eaton Lighting, Hubbell Lighting, Current powered by GE, Cree, Signify (Philips Lighting) and RAB Lighting.

CMG has asked this question each quarter and although some of the variance can be attributed to there being different respondents to the surveys, Gordon traced an overall decline in the dominance of the largest manufacturers. In the Q4 survey, the weighted average was 57.8% of industry lighting sales going to the largest firms, up from 55.9% in Q3, but down from 58.8% in Q2 and 62% in Q1.

The study didn’t delve into the reasons behind the apparent shift. Some of the anecdotal comments gave some hints. One distributor emphasized the reliability of the technology. “The increase in failures has made the warranty issue more of a talking point – but it’s EVERYONE – not just the off-brands so that is opening doors for the lesser known manufacturers.”

With the lighting industry going through substantial changes and the terrain around them obscured by questions over tariffs, materials pricing and policy changes, distributors, manufacturers and reps in the lighting business have an “eventful” year ahead, but one that seems likely to prove lucrative for those who find their way.