Sponsored

2020 started with high hopes for a good year, but by the end of the first quarter the economic brakes were pushed to the floor. One event after another forced a deepening plunge: COVID-19 entered the U.S.; the beginning of an oil and gas price war that, for a brief time, pushed selling prices into negative numbers; a stock market that had the single largest drop in its history; unemployment rates not seen since the Great Depression; and racial and civil unrest. Concurrently, a combined bout of raging forest fires, scorching an estimated 8.3 million acres, along with a busy hurricane season, with at least four making landfall, have resulted in billions of dollars in damages and a disheartening number of deaths, displacements and lost homes and businesses.

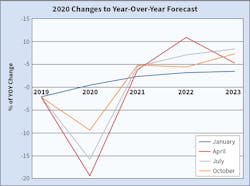

Adding another level of dismay is an extraordinary environment of political rhetoric moving into a heated and highly partisan election season. Obtaining meaningful data and making sense of these events economically has been an ongoing swift and shifting challenge. The DISC Electrical Distribution Market forecast on page 35 (bottom chart) show the significant changes quarter to quarter in the depth of the recession, and the speedy yet bumpy recovery. While the forecast is improving, we continue to teeter on the precipice of another downturn with a potential third wave of COVID cases on the rise.

What will all this mean as we look at future performance for the electrical distribution economy? 2019 was slightly down from an exceptionally good 2018. Current forecast modeling has 2020 to lag behind 2019 by -9.4% year-over-year (YOY). However, we estimate the electrical distribution market will be less impacted than initially thought by the pandemic.

DISC Corp. presently retains our forecast for the electrical market to return to nearly pre-pandemic levels (equivalent to 2019) between 2022 and 2023 (See top chart on page 35). As of now, the expectation for 2021 is for additional YOY growth of growth of +4.8%, slightly easing in 2022 with +4.4% YOY, and strong acceleration of +7.3% in 2023 YOY.

- DISC’s 2020 Contractor forecast is -11.3% YOY from 2019. The forecast for 2021 is +1.7% growth 2020 YOY, and 2022 YOY growth at +6.5%.

- The Industrial sector 2020 forecast is for YOY to be down -11% YOY, with a gain of +6.4% YOY growth in 2021, and +1.9% YOY in 2022.

- The Institutional sector forecast is -6.8% YOY for 2020 with a strong return to growth of +8.8% YOY in 2021 and up an additional +4.6% YOY in 2022.

- The Utility sector forecast is -3.1% YOY in 2020, up +3.7% in YOY 2021, and flattening to +1% YOY growth in 2022.

In April we were forecasting a decline of more than -20% overall in these markets. Now, as we close the third quarter and finish the year, we are looking at a decline of just short of down -10% YOY. So where does all this put us for 2021? Capital spend on construction follows the market as investment in general promises an expectation of future sales growth. Positive movement in pent up industrial demand will carry 2021. Institutional spend will be pushed by changes related to social distancing and communications. Utility spend in MRO and solar also give 2021 a boost.

Looking for opportunity and information outpacing the market in sales growth? We can foresee increases in niche markets like air handling, solar power (both residential and large-scale), wind energy, data centers, healthcare and residential remodeling. These are all market areas that will continue to outperform in 2021. We also see good opportunity in cold storage, building use conversion and warehousing for delivery. Specifically, we are seeing wide-scale usage of shopping mall retail space repurposed as shipping hubs. Although shell structures exist, interior remodeling including electrical and ingress/egress for large delivery vehicles is providing a boost.

Choosing and using market data and having a data strategy should be a key portion of your 2021 sales plan. There are many good sources of data today, and DISC has been providing the electrical distribution community market data for over 40 years. The Electrical Wholesaling Market Planning Guide published each September is excellent, and Dodge Data and Analytics as well as Industrial Information Resources are also trustworthy and reliable resources. My company, DISC Corp., focuses on the electrical distribution community, and we support distributors, manufacturers and independent manufacturers’ reps. We are your resource for cloud-based and custom reporting of supply and demand side market data and market-specific reports down to the county and zip code level.

Christian Sokoll is president of DISC Corp., Houston, the electrical market’s leading provider of sales forecasts and related market data. He can be reached at [email protected] or 346-339-7528.