Sponsored

The utility business is unlike any of an electrical distributor’s other core market segments. That’s because the customers, products, market traditions and knowledge needed to succeed in the utility market are much different from those required in the commercial, industrial and residential markets — which we covered earlier in the Electrical Market 101 series on electrical distributors’ key markets. This article is intended as a training guide or refresher course for salespeople, new employees or support staff at electrical distributors, manufacturers or reps for utility products.

Because of the differences between the utility market and their core commercial/industrial businesses, far fewer electrical distributors pursue the utility business, and according to Electrical Wholesaling data on a national basis it accounts for 4.4% of a typical full-line distributor’s customer mix. Distributors that have succeeded in supplying utilities with their emergency, MRO or general supply needs tend to be either full-line electrical distributors with a time-tested specialty in the business, or niche distributors that focus just on the utility market. For full-line electrical distributors with a major focus in this niche, utility business accounts for 10% - 16% of sales, according Electrical Wholesaling research. These distributors include WESCO Distribution Inc., Pittsburgh, PA; Graybar Electric Co., St. Louis, MO; Irby/Sonepar, Jackson, MS; Border States Electric, Fargo, ND; Codale Electric Supply/Sonepar, Salt Lake City, UT; and Kriz-Davis, Grand Island, NE. With its 2015 acquisition of HD Supply’s Power Solutions Business, Anixter International, Skokie, IL, is the big dog in the utility market, with $1.4 billion in utility product sales (19% of its total 2016 sales). WESCO also does more than $1 billion in utility product sales, and according to its most recent annual report, at 16% of its $7.34 billion in 2016 sales, did $1.2 billion in utility sales last year. OneSource Supply Solutions/Sonepar, Oceanside, CA, is also a big player in this niche.

Also big factors in the utility market are the utility specialists that devote most if not all of their efforts to this market niche. These companies include Western United Electric Supply Corp., Brighton, CO; Tri-State Utility Products, Marietta, GA; Brownstown Electric Supply, Brownstown, IN; and Power Line Supply Co., Reed City, MI. Many of these specialists are members of the 14-member North American Association of Utility Distributors (NAAUD), Smithville, MO (www.naaud.org), a group of 15 distributors nationwide with $2.6 billion in combined utility product sales that stock $440 million of inventory from 30 manufacturers in 230 locations across North America to service storm emergency needs.

Some of the reasons electrical distributors get involved in the utility market are deeply rooted in the electrical wholesaling industry’s history. Graybar, for instance, has been in the utility business since the early 1900s, when many of the first power distribution systems in the U.S. were being built. The only markets for electrical supplies back then were in towns and cities where power companies were beginning to provide electrical service. Graybar set up many of its first branch locations in those markets to supply companies doing construction and maintenance of the new power grids. As power distribution systems grew in the United States, many markets continued to have only one or two distributors that served utilities. This trend holds true today, as in many metropolitan areas just a handful of players compete in the utility market.

The utility market requires a highly specialized package of value-added services, and the players mentioned above usually offer services that include but are not limited to things like:

- 24/7 emergency storm recovery service

- On-site warehousing, storeroom management and/or job-site trailers

- Kitting and customized storm kits

- Highly sophisticated product sourcing and procurement capabilities

- Equipment calibration

- Tool repair

- Safety training

The utility market tends to be a very cyclical business, and double-digit swings in spending on utility projects are not at all uncommon. For instance, Dodge Data & Analytics’ 2017 Construction Outlook said construction of electric utility/gas plants will slide -29% percent this year, to $30 billion, due in large part to bulge in LG export terminal construction in 2016, and the dearth of such mega-billion-dollar projects expected to start up in 2017.

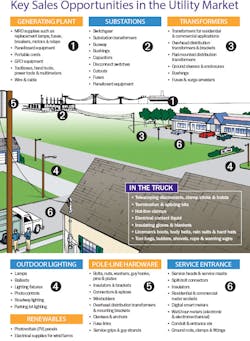

According to the 2017 sales forecasts in Electrical Wholesaling’s Market Planning Guide, electrical distributors will sell approximately $4.5 billion of utility supplies, including, but not limited to, pole-line hardware, high-voltage wire and cable, transformers, fuses, cutouts, panelboard equipment and safety supplies, as well as MRO supplies for use at generating plants such as metering equipment, tools and replacement lamps. For more information on electrical equipment and related supplies that distributors sell to utilities, check out “Key Sales Opportunities in the Utility Market” below.

As is the case in all markets, you’re known by the lines you carry. One independent manufacturers’ rep who has sold utility products for years says an electrical distributor is really not a player in the utility market if it does not carry a premium switchgear line; a good line of transformers; and a top-notch high-voltage wire and cable manufacturer.

Most of the action for utility distributors is in products for the construction and maintenance of local distribution systems. This mix of products depends on whether the distribution systems in a distributor’s market are underground, overhead or a combination of both.

Overhead distribution, in which the power runs along poles to local customers, were for years the service of choice. Utilities sent power over high-voltage lines to substations, where it was redistributed to local customers via power poles. At the point of service, the power is stepped down with transformers to a voltage (most often 120/240V) that customers can use in their electrical systems.

For some time now, most new utility distribution systems have used underground service, where conductors run underground to customers from utility distribution substations. The power is produced at the utility generating plant and sent along overhead transmission lines to utility distribution substations, where it goes underground for distribution. The underground service goes first to pad-mounted distribution transformers and then on to the local hook-ups at the appropriate voltage for use by the utility’s customers.

Although the initial cost of installing underground distribution systems is higher than that of overhead distribution systems, underground power distribution systems tend to be more reliable. These systems often require less maintenance and repair because underground systems are protected from many causes of outages that overhead distribution systems must contend with, such as lightning strikes; automobiles crashing into power poles and knocking out service; storm damage; ice build-up and wet or snow-laden tree limbs that fall into distribution lines.

KNOWING THE PLAYERS

Traditional utilities are commonly divided into three types:

Investor-owned utilities. These are the largest utilities in the land and tend to buy direct for most of their products. They serve thousands of customers.

Co-op utilities. These utilities, including the Rural Electric Associations (REAs,) tend to buy more frequently from distributors, and often serve smaller metropolitan markets or rural areas.

Municipally-owned utilities. These utilities service a small market area, often a town, city or county.

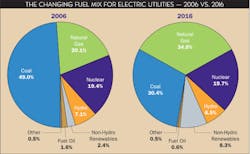

These utilities burn a mix of fuel to create power. According to the Edison Electric Institute, Washington, D.C., for the first time ever, natural gas has surpassed coal as the largest part of the nation’s fuel mix, accounting for 34%. Coal is now at 30.4%, followed by nuclear (19.7%); hydroelectric power (6.5%); non-hydro renewables (8.3%); fuel oil (0.6%); and other (0.5%). As you can see in the Fuel Mix chart on this page, coal had an -18.6% drop over the last 10 years, while natural gas increased 13.9% and non-hydro renewables increased nearly 6%.

While these utilities provide most of the electric power in the United States, other entities now produce power outside the electrical grid in what’s known as “distributed generation.” Companies, communities, universities and government entities are just a few of folks producing their own power off the traditional electrical grid, often from photovoltaic panels, wind turbines or gas-fired turbines, cogeneration or other power sources. They use these power sources to set up their own microgrids.

GTM Research reports 160 microgrids currently exist in the United States, with 1,649 MW of capacity. It expects U.S. microgrid capacity to reach 4.3 GW by 2020. One example of a microgrid being developed is at the Philadelphia Navy Yard, a 1,200-acre former naval shipyard that’s expected to one day have more than 145 companies occupying more than 7 million square feet of green offices and other facilities. When first announcing Alstom’s participation in this project several years ago, Michael Atkinson, president of Alstom Grid North America (now part of GE), said “By combining distributed renewable resources and energy storage assets portions of the campus will become self-sufficient in generating, managing and storing electricity. The campus will be able to operate independently from the main grid in case of an outage due to extreme weather or other extraordinary events.

“Alstom will combine its energy management and substation automation technology including advanced systems and controllers to provide ‘Utility-Customer Nexus in a Box’ supporting end-to-end functions. This includes microgrid islanding, synchronization and reconnection, protection, voltage, frequency, power quality management and dispatch and system resiliency.”

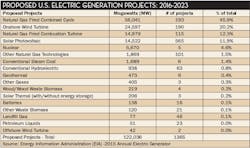

Some fascinating data from The Energy Information Administration (EIA) (www.eia.gov) on the changing mix of fuel sources for electricity generation proves that many of the new generation projects planned or underway involve renewables and non-traditional fuel sources. According to EIA data from its annual Electric Generator Report, from 2016-2013 (see chart on page 21), 122,036 new megawatts will come online in 1,365 individual power projects being built by not only publicly owned electric utility, rural and municipal cooperatives, but private companies for their own facilities, universities for their campuses and other power producers. Roughly 90% of these projects will utilize the following technologies:

- Natural gas-fired combined cycle

- Onshore wind turbines

- Natural gas-fired combustion turbines

- Solar photovoltaic

It’s interesting to note that while electric utilities still account for the vast majority of the new generation coming online, Apple, Archer Daniels Midland, BJ’s Wholesale Club, Formosa Plastics, Georgia-Pacific, Merck and Sierra Nevada Brewing Co. also want to produce their own power and have projects either underway or planned.

IMPACT OF DEREGULATION

You can’t talk about the utility market for very long without touching upon deregulation. The move to open up the utility market more than 15 years ago so other companies could compete with the established utilities that had a monopoly to sell electricity in local markets hasn’t always had the intended effect of driving down the price of power for end users. But it has forced electric utilities to change how they do business. Following are a few examples.

Expansion into other markets. Along with selling kilowatts, many utilities always had other services to offer, such as the installation and maintenance of street lighting for towns, counties and states. But deregulation forced them to look at new markets, and they expanded into a much more extensive packages of services, including the design, installation and maintenance of indoor lighting, power quality and power distribution systems for industrial facilities, and sophisticated metering packages for the smart grid that allow their customers to analyze their own power usage.

Getting into electrical contracting. The idea of a utility fielding its own installation crew, whether made up of its own employees or of electricians sub-contracted from contracting firms, presents several potential challenges for your contractor customers. The installation, maintenance and design is obviously in direct competition with the services electrical contractors already provide. Over the years, MDU Resources Group Inc., Bismark, N.D., emerged as a force to be reckoned with in the utility contracting business through the acquisitions of several electrical contractors that focus on this niche. It competes against other national contractors, such as Quanta Services Inc., Houston, for utility work. According to information on the MDU website, during the peak season its Construction Services division has about 4,500 employees. It’s ranked #13 on Engineering New Record’s 2016 Top 600 Specialty Contractors list based on revenues and is authorized to operate in 47 states.

About a decade ago, utilities were also very interested in getting into the ESCO market and were buying or starting up their own energy-service companies. That trend seems to have subsided and ConEd Solutions, Valhalla, NY, appears to be the largest utility-owned (ConEd) ESCO in the market.

Competing for customers motivated utilities to cut operating costs. Deregulation forced utilities to rethink how they purchase, stock and distribute electrical products that they use for their power systems, as well as MRO needs at their generating facilities. These are services distributors can provide.

CHANGING EXPECTATIONS

All of these changes in the market have affected what utilities expect from distributors of utility products. Stability is a key concern, as are product and market expertise. According to one utility specialist, electric utilities are looking for much more than just the lowest price when they are shopping for a distributor to service one of their coveted long-term contracts:

An effective inventory management system. Utilities, more than many other types of customers, want the distributors they do business with to have their inventory on computer. That’s because utilities must be able to rely on a distributor’s assessment of product availability. During emergency situations or power outages, utilities have to know the products they need will definitely be in stock, so they can repair damaged equipment as soon as possible.

Prior performance and experience. As mentioned earlier, the utility market is not a game for amateurs, and utilities expect distributors to know the products they will need and the type of service they require. Utilities may also want to know which other utilities you are working with so they can check these references.

Primary markets served. Utilities will evaluate electrical distributors based on the markets they serve because this will give them a good idea of what size of customer a distributor serves best. For instance, if an electrical distributor focuses on industrials and large-project work, it’s less of a stretch to manage the volume and technical complexity of product that a utility often requires, than if that distributor’s niche is light-commercial and residential work.

Brands carried and product mix. A distributor that carries heavy-commercial and industrial lines for manufacturers that also make utility products stands a better chance of making a smooth transition into the utility business than does a distributor that focuses on small commercial and residential.

Geographic service area. Like any other customer, an electric utility needs reliable distributors that can deliver product on an on-call basis, 24 hours a day. Utilities outside an electrical distributor’s primary service area lose the benefit of counter pickups, and run the risk that the deliveries may not be as dependable as that of a distributor with a branch nearby.

Financial stability. Utilities don’t want to run the risk of partnering with an unstable electrical distributor because it can take so long for them to develop effective supply sources.

AN EXCITING FUTURE

Utility industry insiders are optimistic that any discussion in Washington, D.C. by Congress on infrastructure spending will include investments to protect the nation’s electrical grid from cyberattacks and to modernize to keep up with the wave of new generation technology. In the Edison Electric Institute’s Wall Street Briefing in Feb. 2017, Thomas Kuhn, EEI president told attendees a transformation in the utility industry is being driven by declining costs for natural gas and renewable energy resources that are developing at scale; changing customer expectations; environmental regulations and the growth of distributed energy resources, including energy storage, private or rooftop solar, microgrids, demand response, energy efficiency and electric vehicles.

Electric utilities are spending big bucks to keep up with this transition and in the Wall Street Briefing, David Owens, EEI’s executive V.P. for the Business Operations Group and Regulatory Affairs said EEI utility members spent $52.8 billion on grid infrastructure in 2016, and that much of this investment over the past few years has been on the smart grid and smart meters — the digital link between customers and utilities. Total capital expenditures by EEI members (including spending on generation facilities) was projected to hit $120.8 billion in 2016.

“The smart grid is the enabling platform for integrating more clean and distributed energy resources; providing the services and solutions customers want and improving reliability and resilience,” he said. “By year-end 2016, it was projected that 70 million smart meters would be installed across the United States. The continued deployment of digital smart meters is one key building block of the smart grid. Others include energy storage; microgrids; advanced communications and data management systems; digital sensing, monitoring and control capabilities; and data analytics.”

Although the utility market is changing rapidly, outside of smart meters and other AMI (Advanced Metering Infrastructure) equipment and LED streetlights for municipal lighting contracts, their basic package of pole-line hardware and related equipment probably won’t change all that much. What may change quite a bit over the next few years for utility players in the electrical market is the mix of power producers they sell to, because as mentioned earlier it’s expanding rapidly past traditional electric utilities and now includes private companies, universities, municipal governments and related county or local entities. But by focusing on the market basics that this article outlines, you will have a better idea of what it takes for electrical distributors to win in the utility business, today and tomorrow.