Sponsored

From the largest industrial conglomerate in smokestack America to the smallest machine shop in an industrial park a market exists for electrical supplies that accounts for an estimated 32% of all sales through electrical distributors. According to Electrical Wholesaling magazine’s 2020 Market Planning Guide, this market will account for approximately $37 billion in sales through electrical distributors when you count in all the MRO, OEM and factory automation applications for industrial products.

When people think of the industrial market, too often they just think of massive industrial plants — assembly lines building sport utility vehicles; steel plants with huge vats pouring molten steel into forms; or colossal factories cranking out the products that fill the shelves of every Main Street shop or big-box retailer. But a huge portion of the industrial market is in the smaller but more numerous manufacturers that produce products built into other products — the seat covers for that SUV; the machinery that mashes and molds that steel into other products; the packaging for those items on a store’s shelves; and for zillions of other types of products or businesses. Thousands of smaller customers exist in a broad array of industries, including pulp, paper and timber; chemical manufacturing; refinery operations; bottling; packaging; machine-tool building; food processing; military and aerospace products; and heavy industrial and construction equipment.

These industries have an enormous appetite for electrical products such as lighting equipment; wire and cable; fittings; connectors; terminals; conduit and wiring systems; motors and motor controls; hazardous locations equipment; sensors; WIFI network equipment; programmable logic controllers (PLCs); circuit breakers and fuses; switchgear; voice/data/video (VDV) products; power conditioning equipment; signaling equipment; building management systems; machine-vision systems; bar coding equipment; and electricians’ supplies.

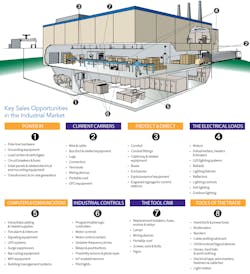

Don’t forget some of the new-generation products such as IoT-enabled sensors that monitor manufacturing lines, lighting, WiFi networks, HVAC systems and related building automation networks; LED lighting systems; the products needed for on-site energy generation systems like standby generators, photovoltaic (PV) panels; and natural gas or cogeneration-fueled turbines that produce energy off of the pubic power grid. Check out the illustration on pages 20-21 to see how these products might fit into a typical industrial application — and provide a sales opportunity for your company.

Selling a package of products ranging from tiny wire terminals to towering motor control centers and the latest in IoT technology, as well as stocking and talking knowledgeably about the hundreds of related products, is not an easy task. This article provides an overview of the industrial market for newcomers to the electrical wholesaling business, as well as for industry veterans who want to brush up on the basic trends shaping this market or discover new strategies for scaring up industrial sales opportunities.

While the electrical systems are often much larger in industrial facilities than in the commercial market, with a few notable exceptions such as PLCs, industrial sensors and hazardous locations equipment, the products used in the industrial market are in the same basic product families as those used in commercial applications.

Electrical products designed for industrial applications often are a bit brawnier than their brethren in the commercial world, but that’s usually a function of the size of the electrical system and the sometimes-atrocious living conditions they must endure. Electrical products in industrial applications are tortured with extreme heat or cold, oily mists, corrosive liquids or gases, water, dust and grime, or potentially explosive environments. That’s why industrial electrical products and systems must be carefully protected with the proper wiring systems, enclosures, junction boxes, or, in the case of wire and cable, tough insulation.

To get a fix on where the best sales opportunities are in the industrial market, let’s look at the other key trends shaping this business.

The key market indicators that track the industrial market reflect a business that’s growing but is still far below historical levels. One thing about the industrial market has held true over the years — when it’s strong, business can be very, very good for the electrical wholesaling industry. But when your industrial customers are suffering from a dearth of demand for their products and they are not building new production lines or refurbishing existing facilities, business is tough. You also must factor in the smaller industrial base in the United States, because so many companies have moved offshore to countries that offer less-expensive manufacturing.

According to the 2020 Dodge Construction Outlook published by Dodge Data & Analytics, “Manufacturing construction peaked in 2018 at $32.8 billion (84.7 million square feet) and will tumble sharply in 2019, followed by another decline in 2020. The downturn is the result of the U.S.-China tumult over trade and tariffs that has pushed the U.S. manufacturing industry into decline. After falling 16% in 2019, the square footage of starts will slide another 9% in 2020 to 64.4 million square feet. Dollar value fell a steeper 29% in 2019 and will then drop just 2% in 2020 to $22.7 billion.”

The industrial market is still a huge part of the U.S. economy, and in some areas of the country it’s doing well, particularly in areas where auto manufacturers are building new factories or renovating existing facilities, like in parts of Michigan, South Carolina, Alabama or Tennessee. And when the auto industry is expanding, it also creates sales opportunities in feeder industries. Along with the auto plants themselves, you have hundreds of companies manufacturing equipment for new cars, including tires, seats, headlamps, sound systems and a gazillion other OEM products.

Last year, Ford announced that it would invest approximately $1.5 billion in two of its Michigan assembly plants, according to articles in the Wall Street Journal and on www.curbed.com. It’s investing $750 million in the Wayne plant to produce new assembly lines for its Bronco and Rangers SUVs and trucks. Its $700 million investment in the Dearborn, MI, plant will fund production of batteries for hybrid and electric versions of its popular F-150 truck and SUVs, which are expected to hit the streets in several years.

THE IMPACT OF ELECTRIC VEHICLES

Ford’s investment in electric vehicles is another example of a new trend in the auto industry that’s starting to take root. The Tesla Gigafactory near Reno, NV, has been producing electric vehicles for several years, and the company is now manufacturing electric vehicles at a new gigafactory in China and plans to build a new one in Germany over the next few years, too.

Arizona will also be the home to an electric vehicle factory. Late in 2019, Lucid Motors announced that it would invest in $700 million in a factory in Case Grande, AZ, to build a new line of electric vehicles. The Public Investment Fund of Saudi Arabia has already committed to a $1 billion investment in the facility, expected to open by early 2021.

Another interesting development in the EV market is that Cree will invest $1 billion in a plant near Utica, NY, to produce silicon-carbide wafers for electric vehicles and 5G networks, according to a post in 3Q 2019 on www.syracuse.com.

A niche within the industrial market that’s pumping billions of dollars into some regional economies is the petrochemical industry, which in 2018 accounted for a third of all new construction dollars in the industrial market, according to Dodge Data & Analytics. Because of the size of these multi-billion-dollar projects, they often skew the month-to-month and year-to-year constructions statistics when these projects break ground. It’s still one of the busiest niches in the construction market, particularly along the Texas-Louisiana Gulf Coast. Another large petrochemical plant underway is the giant Royal Dutch Shell plant about 30 miles north of Pittsburgh in Monaca, PA.

DATA THAT MATTERS

If you want to get a snapshot of the industrial market’s health on a national basis, here are several good economic indicators to track:

- Capacity utilization

- Machine-tool orders

- Purchasing Managers Index

- Non-defense durable goods orders, excluding transportation

- Manufacturing employment

- Manufacturers’ shipments

- Baker-Hughes rig count (if you are interested in the oil & gas market)

Published each December, Electrical Wholesaling’s annual “National Factbook” tracks many of these indicators. You can access the magazine’s most recent analysis at ewweb.com, by typing “national factbook” into the search engine at the top of the right column.

Capacity utilization. This statistic follows manufacturers’ industrial capacity and how much of it is being used. According to the Federal Reserve Board, total capacity utilization was at 77.2% in 4Q 2019, below the 1972-2016 industry average of 79.8%. As rule of thumb, when the capacity utilization number hits 80%, manufacturers will look to expand capacity. Check this website for current data: www.federalreserve.gov/releases/g17/Current/.

Machine-tool orders. Published by the Association for Manufacturing Technology (AMT), this is an important leading indicator because it measures the sales of the machines on the factory floor that do the actual shaping, cutting, bending, forming and perform other manufacturing processes. Last year’s production data ended on a high note, with December’s orders of $397.55 billion being the highest since March 2019. However, the year-over-year (YOY) don’t get too freaked out when you see monthly numbers fluctuate by 20% or more. To track monthly data go to www.amtonline.org.

Manufacturers’ New Orders - Nondefense Capital Goods Excluding Aircraft. If you want to find out the total monthly sales of big-ticket items such as automobiles, refrigerators, computers and other electronic equipment, track the durable goods orders posted each month by the Department of Commerce at www.census.gov/indicator/www/m3/index.html. Most economists look at subsets of these numbers, particularly Manufacturers’ New Orders: Nondefense Capital Goods Excluding Aircraft. This data strips out the volatility of orders for aircraft and defense spending, which tends to appear in huge lumps that skews that month-to-month increases of the rest of the data. In its “FRED” treasure trove of economic statistics, the Federal Reserve Bank of St. Louis offers this report in an easy-to-digest downloadable format through this link: https://fred.stlouisfed.org/series/NEWORDER. The latest year-over-year data showed that 2019 was up roughly +1% to $88,617 million.

Purchasing Managers Index (PMI). The Institute for Supply Management (ISM), Tempe, AZ, formerly known as the National Association of Purchasing Managers (NAPM), offers a wide variety of statistics on the purchasing activity of manufacturers and service companies on its website, www.instituteforsupplymanagement.org. One of the many useful statistics on this site is the Purchasing Managers Index, which tracks purchasing activity on a national basis, as well as by industry. Many economists rely on this data as leading indicator of future industrial purchasing. Any reading over 50 in the index points toward a healthy purchasing climate. After several months in contraction territory, the Jan. 2020 data finally broke through the 50-point level with a reading of 50.9% that was up a healthy 3.1 points over Dec. 2018.

THE BIGGEST MARKET TRENDS

Maintenance, repair and modernization of electrical systems continue to account for about half of all electrical work performed in industrial facilities. New construction of industrial facilities often directly depends on demand for the products that the plant produces. It’s also affected by local or national economic trends and the financial health of that company. As in any new construction market, distributors ride the ups and downs of new industrial facility construction. When the construction of new industrial facilities is hot, the sales potential is huge. But when customers are not building new facilities, distributors must take advantage of the more consistent demand for electrical products needed for the repair, retrofit and modernization of existing buildings.

The nice thing about this market is that it’s seldom as cost-sensitive as new construction work. The gross sales dollars may not be as big, but the profit margins tend to be much higher. Customers need distributors that can react immediately on their demands for repair products, and price is seldom as much of an object when a key assembly line is down because of a malfunctioning electrical component.

A relatively small group of manufacturers produce huge amounts of the products for the industrial market. Full-line distributors aren’t big players in the industrial market unless they stock at least one of the following lines: ABB, Rockwell Automation/Allen-Bradley Co., Schneider Electric, Eaton or Siemens. ABB (which acquired GE Industrial for $2.8 billion in 2018), These companies provide not only industrial control and motor-related products, but broad distribution equipment and switchgear packages, too.

Integrated-supply arrangements evolved and survived. A decade ago, you could not pick up an industry publication without reading about a new integrated supply agreement. In these arrangements, noncompeting distributors of industrial, MRO and construction products band together to offer mutual customers a single-supply source for many MRO needs. These integrated-supply partnerships tend to target the largest industrials, but they also work for large companies with multiple facilities such as Fortune 500 companies and utilities.

During the dot-com era, more than a dozen of these groups existed, as dot-com companies from outside the distribution industry, with names like purchasingcenter.com, totalmro.com and equalfooting.com, thought they could replace existing channels of distribution by taking all of this business online.

These dot-com entrepreneurs burned through their venture funding, and many distributors with an interest in integrated supply or national accounts are now part of at least two large groups, each with a slightly different background and focus: Vantage Group, Crystal Lake, IL.; and SupplyForce, King of Prussia, PA. SupplyForce spun off from Affiliated Distributors in 1999 and in 2014 merged with Vanguard National Alliance, Malborough, MA, to provide nationwide support of national contracts for Rockwell Automation distributors.

More electrical contractors are being hired to do on-site maintenance work at manufacturing facilities. This trend has been happening for years because your industrial customers can cut operating costs by farming out their electrical service work. This is an important trend for electrical distributors, because it can change the buying influences. Check with industrially oriented electrical contractors in your market to see if they are involved in this type of work.

As the automation of the factory floor has evolved over the past 30 years, end users have been able to monitor, collect and process unprecedented amounts of information. For years, distributors provided the hardware that made this happen, such as programmable logic controllers, sensors, relays, pilot lights, variable speed drives, enclosures, cabling and related connectors.

But as the need to collect and process this information increased, distributors’ customers began asking for high-speed communications systems to carry information from the factory floor to the corner office, or to other facilities. Along with conventional industrial communications networks constructed of shielded twisted-pair cable, coaxial cable or fiber-optic cabling, IP-enabled sensors and sometimes WiFi networks now send data wirelessly to the cloud over the internet. It’s one example of how the IoT is now changing the electrical market.

It’s no longer enough to just provide the “nuts-and-bolts” for the factory floor. Distributors’ customers are looking for a one-stop solution in supply and software programming. In fact, the software has become such a big part of the sale that products such as PLCs that were once considered the highest of high tech have become commodities.

All the major players in industrial automation have built up their software capabilities. As Electrical Wholesaling reported several years ago, “Manufacturers in the industrial automation space have grasped the potential of building a robust industrial data platform and this year actively positioned themselves through acquisitions and internal structural changes to pursue the industrial IoT (IIoT) as a primary emphasis for future growth. We’re now seeing a high-stakes race among large industrially oriented electrical manufacturers to realize the IIoT’s potential, each seeking to establish a standard software platform for gathering and interpreting data in the manufacturing, process, infrastructure, utility and related industries.”

This trend means that distributors either must have the programming capabilities on staff or partner with companies such as systems integrators that have this expertise. Remote management of an industrial facility’s electrical system over the web helps alert maintenance personnel of blown breakers, power fluctuations, energy usage and dozens of other electrical measurements.

OSHA has gotten more serious about trying to stop electrical accidents on the job. The Occupational Safety and Health Administration (OSHA) continues to enforce its regulations to make industrial plants safer workplaces, and these regulations have created sales opportunities for electrical distributors. The “lockout-tagout” rules require industrial facilities to use specially designed lockout tags to ensure the circuits electricians are working on cannot be inadvertently energized by other workers. Other requirements call for proper signage, GFCI protection of many electrical circuits, and frequent inspection of portable cords to ensure that they are always in safe working order.

New products that do jobs better, faster or at less cost than traditional electrical products will continue to attract customer interest. For instance, IoT-enabled equipment is now a reality; new types of cable tray systems offer customers more options in wiring systems; the move toward modular electrical equipment has increased the demand for multiple-contact connectors; and ever-more efficient lighting systems offer solid ROIs. They offer real-world benefits to your customers — and provide a solid sales opportunity.