Sponsored

Truly a black swan event of epic proportion is upon the entire world. The need for mandated social distancing measures has halted a large portion of the global economy. This is compounded by a contraction in oil prices deepened by a lack of demand. Massive layoffs and sharp contractions in financial markets are undermining personal wealth. Unprecedented drops in demand for goods and services may instigate the largest drop in domestic GDP ever.

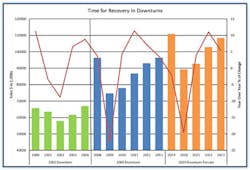

These events carry longer-lasting implications for recovery. That said, the electrical community is deemed, as it should be, an essential business. We have weathered downturns before and will again. The chart below shows the downturn and recovery cycles of 2002 and 2009 as well as the current DISC forecast for this 2020 cycle. The bars in the charts below represent dollars of sales and the line is year-over-year (YOY) percentage of increase/decrease.

DISC’S BASELINE FORECASTS FOR 2020-2023

Overall market forecast. The current forecast is to return to pre-pandemic levels by 2023 (equivalent sales dollars to 2019). The current but changing expectation for the overall electrical distribution market is to finish 2020 down -19.6% below 2019 year-over-year results. As stated in our last update, we expected further downward revisions as we continued to gather data, our last forecast as of late March was -12.4% YOY. As of now, the expectation for beginning the recovery cycle is in 2021 with a YOY increase of +3.9%. We are forecasting stronger acceleration in YOY growth of +11.4% in 2022. The 2023 forecast of +5.4% growth puts us in reach of 2019 sales.

Contractor. The revised Contractor Sector forecast is down -24.8% YOY for 2020 with the bulk of the downturn falling in 2020 Q3 and Q4, as construction markets tend to lag other markets. However, stay at home, social distancing and construction stoppages will heavily impact Q2 results, followed by steeper declines later this year and into the start of 2021. The forecast for 2021 is down overall -1%, followed by 2022 growth of +19.1%.

Industrial. The revised Industrial Sector forecast is for 2020 to be down -20.7%. Supply chain disruptions, factory closures and a drop in demand for goods and services due to illness and social distancing measures will continue to drag recovery through the year. We forecast a return to +5.7% growth in 2021 as government intervention with rate cuts and other aggressive fiscal policy measures start to positively impact the sector. In 2022, growth will climb to +6.3%.

Institutional. The revised Institutional Sector forecast is down -10.9% for 2020 with a return to growth of +6.9% in 2021 and +5.5% in 2022. A unique opportunity for construction in educational and other normally highly populated facilities currently exists, as closures allow for less restricted access to complete improvements and upgrades.

Utility. The revised Utility Sector forecast is down -9% in 2020, up +1.5% in 2021, followed by a +5.4% increase in 2022.

DISC’S CURRENT 2020 QUARTERLY FORECASTS

The COVID-19 pandemic will continue to negatively and unpredictably pressure results through the balance of the year. Expect these forecasts to be revised in the weeks ahead. We currently anticipate a measured and slow market rebound beginning in 2021 with a return to positive results mid-year 2021 and recovery to pre-pandemic market levels in 2023.

The DISC Monthly Flash report is a more in-depth look at the current detailed information by sector, economic indicators, and the drivers of economic activity focused on the electrical distribution community. Please visit www.disccorp.com to learn more, or call (346) 339-7528 to find out how to obtain your copy.