Sponsored

#1. Customer counts. How many active customers do you have in the current period vs. the number of active customers you had in the prior period? You should always focus on adding new customers while retaining the established ones. DISC Corp.’s feature article published in the Nov./Dec. 2021 issue of Electrical Wholesaling, “Mapping Out Market Clusters,” is a good way to look for new customers in areas where you already have market knowledge. While getting new customers is more expensive than keeping the existing ones, it’s vitally important to prospect and find new customers.

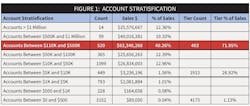

#2.Customer stratification. This is a key tool in helping move customers up in sales buckets simply by identifying them and adding a bit of good old customer service. Tier your customers by sales volumes and counts. “Fig.1: Account Stratification” below will give you an idea of what this looks like. This table has three large tiers and nine smaller tiers. You can see from this chart that of approximately 6,500 customers, 493 are doing just short of 72% of the business.

#3. Invoice count. Increasing the number and frequency of invoices can drive market share gains. When your salespeople get customers to place more orders with increasing frequency, it’s a solid sales practice for growth. Remind your sales team to utilize multiple points of contact and to reach out more frequently to their customers. Make sure they are maximizing all available communication channels, including e-mail, phone, text and web inquiry forms, because it can move the needle on this metric.

#4. Product group counts. This metric goes along with invoice counts. Asking questions at the point-of-sale is a great way to increase the number of product groups you sell to an individual customer. Ask leading questions to introduce related products, such as, “Do you need cable ties and connectors with that wire?” or, “I also have a new cable cutter in stock that I think you would really like.”

It’s likely you have some add-ons that the customer may not be aware that they need or that they can purchase from you. Helping to simplify their life by clumping these complementary products can save them time and energy from contacting another vendor. Building a model that shows your company's salespeople their sales by product group for each customer is a great way to utilize business intelligence along with the power of Excel to capture more market. “Fig. 2: Customer Sales by Product Group” below illustrates this metric.

#5. Piece counts and/or weight shipped. Another measure of market share is piece counts and/or weight shipped. When prices by product group are skyrocketing, consider different ways to measure results by product category. Electrical Marketing’s Price Index is reflective of the differences in inflation by product group. Wire is good example of a product group that can easily be overestimated when looking at a revenue perspective. In April 2020, the price of copper was $2.30 per pound. In April 2022, copper was $4.80 per pound, a difference of $2.50. Considering that 500MCM has 1,544 pounds of copper in a 1,000-foot reel, you could sell half as much and generate more revenue. Measure the weight of what you sell, or in the case of hardware and wiring devices, measure the piece counts over time. #6. Removing the inflationary component of total revenues. Another way to get a more accurate measure of your sales revenue results is to remove the inflationary component from both your sales and the market data. “Figure 3: Long-Range Electrical Equipment Sales” below gives you a visualization of the impact inflation has had on the growth in the electrical distribution market. DISC can help you to look at the market from a normalized perspective, removing inflation to better see your actual results. As always, please feel free to reach out to me with questions or comments.