Sponsored

When you dig deeper into economic factors that will have the biggest impact on business conditions in the electrical market, you soon uncover one central challenge that influences most others — inflation.

Inflation seems to be slowly moving in the right direction after rising to levels not seen in decades during and shortly after the COVID shutdown. But if inflation stalls at current levels, the challenges the electrical market is currently having with higher product prices, the slowdown in spending on construction projects or business expansion because of higher borrowing costs, and tough times in the housing market because of higher mortgage costs will continue. The higher interest rates could also tamp down demand for the stocks of publicly held electrical manufacturers, distributors and contractors.

Despite the concerns over inflation, distributor respondents to several recent surveys, as well as most construction industry economists and Wall Street analysts, don’t see a recession in 2024. Nick Lipinski, an equities analyst with Vertical Research Partners (VRP), who manages the quarterly EW/VRP survey on electrical market conditions, says the responses on 2024 demand were mixed. Election noise may impact decision-making in 2024, says Lipinski, but distributor respondents in the Q3 2023 survey agreed projects already underway will be seen to completion. He said that while the survey forecast of +3.3% growth over Q2 2023 (+2.7% volume growth and +0.6% of price) was generally in line or above expectations, several distributors noted a marked slowing in day-to-day activity in October.

MODEST GROWTH IN NONRESIDENTIAL CONSTRUCTION

In his July 2023 commentary on the updated 2023 Consensus Construction Forecast, Kermit Baker, AIA’s chief economist said spending on nonresidential buildings has been growing at a “torrid” pace so far this year. “Even with the expected moderation during the second half of the year, the AIA Consensus Construction Forecast Panel is projecting that spending will increase by just under +20% for the year,” he said in his analysis. “That pace of growth hasn’t been seen since the construction boom years leading up to the Great Recession. Leading the charge is the manufacturing sector, where spending is projected to increase more than +50% this year on top of an exceptional performance last year. And while industrial construction spending is expected to be the bright light, healthy gains are expected across the board, with both the commercial and institutional construction categories projected to increase at a double-digit pace.

HOW TO USE THE MARKET PLANNING GUIDE

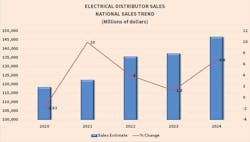

Methodology. Normally, the print edition of our annual Market Planning Guide includes a sales estimate for the next year, as well as some insight into distributors’ anticipated capital expenditures and their expectations for business conditions in key market segments. Unfortunately, this year the response rate for this survey was not high enough at press-time to publish a statistically viable forecast for 2024, so EW’s editors a published the 2024 sales forecast in this article in the first chart.

DEVELOPING SALES ESTIMATES

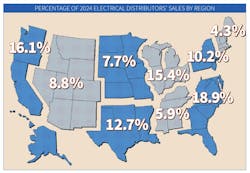

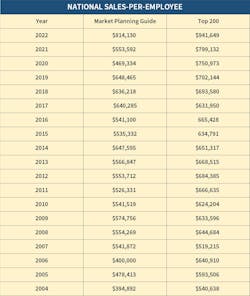

Multipliers. Each multiplier is a dollar figure that represents the average amount of electrical products distributors sell to each particular type of customer, on a per-employee basis or other “economic factor.” (See EW’s National Multipliers in the chart). When used with the employment figures in the regional profiles, the multipliers help establish the amount of business electrical distributors could do with major customer groups in your area and in total.

Using multipliers results in a dollar figure for market size that tells the level of business distributors in the area could do if every potential customer bought a typical amount of product from them. It tends to be a larger number than actual sales.