The Art & Science of Sales Forecasting in the Electrical Market

The supply of electrical products is not an end in itself. But that’s the conventional way we size this industry, or in fact any industry — in terms of sales or revenues. But is this really the best metric?

That depends on what you are trying to measure. At the most aggregate level, supply equals demand — what distributors sell is what customers buy. (For 2013 it’s about $90 billion). We are talking about distributors as the supply side to the end market customer, not talking about the manufacturer as the supplier.

But in what sense is supply equals demand meaningful when we know distributors are located in nearly 1,400 counties and that “demanders” — end customers — are located in about 3,100 counties. Clearly, supply does not equal demand at any level other than at the most aggregate level.

We recognize essential market information as industry sales at the trading area level. But this is using the supply side as the fundamental yard stick. The benchmark is the U.S. Bureau of the Census, which collects and reports distributor sales to the county level. However, there is no benchmark for the demand side in the same sense there is for the supply side. There is no Census Bureau reporting what customers buy from anyone, only what is sold.

Who pays the bills? While there is no formal identification of the demand side of the electrical industry, it’s the demand side that pays the bills. Don’t we need to know at least as much about the demand side, even though we do not have as much information about the customer as we do about the distributor?

Market share from the supply side or the demand side. In terms of market share, a very strong case can be made for greater importance to the demand side. Here’s a case in point. We forecast industry sales (the supply side), and we plan our businesses on those forecasts. But from the distributor’s point of view what we are really forecasting is the outlook for the distributor and his competitors. The demand for electrical products is accounted for only implicitly.

But when a distributor looks at the outlook for industry sales or measures his market area for the current year or previous years, what he is really looking at is his market share versus his competitors. Or in other words, his competitive position. That share speaks to strengths and weaknesses, or “us versus them” in the supply side arena. While that is a valid measure, is it the most crucial market share to evaluate?

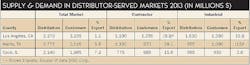

Hard facts on the ground. The table above shows the three largest counties in the U.S. served by electrical distributors (Los Angeles County in California, Texas’ Harris County, and Cook County in Illinois), including their sales and the demand by customers located in those three counties, for total, contractor and industrial segments.

For the total market, distributors located in those counties sold more than customers purchased. In other words, distributors exported supplies to other areas. For the contractor market, distributors in Harris and Cook Counties exported a significant amount to other areas. But in Los Angeles, customers located in Los Angeles imported nearly 9% of supplies from other areas.

For the industrial market, distributors in Los Angeles and Cook counties exported a significant amount to other areas. But in Harris County end customers imported 15% more supplies from other areas than were sold by distributors in Harris.

Multipliers. Multipliers are a useful tool to measure account potential (demand). We recognize wide differences exist between multipliers nationally and by trading areas. And there are wide differences between multipliers by segment and multipliers by specific industry. Strategically, start with demand at the top, measure account potential, add it up and then see how much you are missing. Now you have a reasonable measure of the demand side overall. You don’t need to add the multipliers to determine the total demand.

What’s the message? The gut level question is that in any trading area, what market size should you be measuring yourself against? Other distributors? Final demand for your products? It’s the demand side that drives the industry. In my opinion, identifying demand is the most crucial element for measuring performance where the action takes place, at the trading area level.

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.