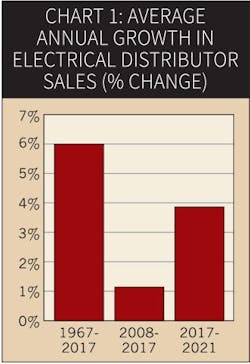

What’s low growth? Here’s a benchmark — over the past 50 years average annual growth in the electrical distribution industry was 6%.

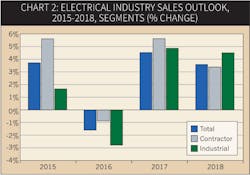

It’s been five years since industry growth reached 5%, let alone 6%, or better (2012, up 7.2%). Since then industry sales growth has hovered around 3.5% with a nearly 2% downturn last year. This year we are climbing out of the downturn with an expected 4.5% sales gain. Here’s another stat: Over the last 9 years, 2008-2017 (since the Great Recession) industry sales averaged just 1.1% growth annually.Is this the New Normal? In the short to intermediate term we are operating in an environment that produces average annual revenue growth in the 1% to 1.5% range. In the long term we were operating in the 6% range.

That’s a huge difference. If the long-term annual average growth was maintained over the last nine years distributors and vendors would have had another $60 billion in revenue in 2016. The difference between 6% and 1.5% drops right to the bottom line.

Unfortunately, DISC analysis points to a “New Normal.” Over the next forecast cycle, 2017-2021, annual industry sales are projected to average 3.9%. That is a far cry from the long-term industry average of 6%. This year we are confident industry revenues will advance 4.5%. But we see a tough year in 2018. Look for industry sales to advance about 3.5%.

We’ve put a lot of numbers in this article. In the first instance they are not hypothetical. Over the last 50 years that’s hard evidence. Over the last nine years that is hard evidence. Beginning with next year and through 2021, that is a forecast, not a certainty. But there’s not a lot of wiggle room in this forecast.

We’ve made some political assumptions, like no economic stimulus next year, which may or may not happen. But this is our best point forecast, given our analysis of the key economic factors driving the behavior of the electrical distribution industry.

These key economic factors do not include GDP. We often hear comments about industry sales following or keeping up with GDP. Let me dispel this myth. In 2009 during the Great Recession electrical distributor sales fell 22%. During that same period GDP fell 2.8%. Where is the relationship between the two? Any discussion linking the behavior/performance of the electrical distributor industry to the behavior/performance of GDP is not fruitful, to put it mildly.

We are in a box because managers in the electrical industry will need to find a way to make money in a low-growth environment. Not everyone can take share. But you can grow profits by focusing on productivity. And there is clearly a link between improving productivity and taking share. Chart 3 shows what productivity in this industry looks like. It includes all the electrical distributor competitors. There are some distributors who fall short of the industry’s productivity and others who exceed it.

In the October 2017 DISC Report, Michael Marks of Indian River Consulting Group zeroed in on how to increase productivity in your business. He effectively tackled key resources every distributor must manage. If you are interested in his remarks please contact me and with his permission I will send them to you.

Summary. We see a New Normal in the electrical industry. Over the past nine years, industry sales growth has been underperforming long-range growth by about 5% on average. We do not see 2018 as a particularly favorable year for the electrical industry, as 2018 sales will be off about a point from this year. Our long-range outlook projects average annual industry sales up nearly 4%, but that’s still a couple of percentage points below historical long-range industry sales growth.

The author is president of DISC Corp., the industry’s leading provider of electrical sales forecasts and related economic data. If you have any questions about DISC’s subscription-based data services, contact Isenstein at 203-799-3673 / [email protected].

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.