Give it away give it away give it away now

Give it away give it away give it away now

Give it away give it away give it away now

I can’t tell if I’m a kingpin or a pauper.

From the song “Give It Away”

– The Red Hot Chili Peppers, 1991

If the headline of this article got your attention, or the lyrics to the Chili Peppers’ song did, it could be because you believe getting the lowest cost leads to good things. Or, you may have already seen how getting the lowest cost can actually reduce your gross margin dollars, and you’re curious about how to actually profit from getting the lowest cost. But the real dilemma with getting the lowest cost is exactly what the Chilis say in the last line of the chorus above: “I can’t tell if I’m a kingpin or a pauper.” Well, we can help you with that. Here’s how to tell:

You have to know if getting the lowest cost leads to BAD things or GOOD things. And if you’re curious how to profit from the lowest cost, you’re asking the right question.

So we’re going to address three things in this article:

1. How to get the lowest cost for stock business.

2. How to price to make the most margin dollars with it.

3. How to manage salespeople with regard to cost and pricing.

Before we address these, we’re going to explain how getting the lowest cost can lead to bad things.

How the Lowest Cost for Stock Business Can Ruin Gross Profit Dollars

It never ceases to amaze us how distributor personnel get so pleased with themselves for getting the lowest into-stock cost from the manufacturer. They get some perverse pleasure from winning versus competitors or “getting it out of the manufacturer.” But they often miss the whole point. It’s not about getting the order. It’s about making profit on the order.

So we’re going to be purveyors of the painfully obvious here for a minute.

The #1 goal of a distributor is to make gross margin dollars on transactions. If getting the lowest cost leads to less gross margin dollars, then you have not won at all. You have lost for everyone: You, the manufacturer, your salespeople, and the whole operation. Why? Because the transaction costs stay relatively fixed. It still costs you the same for all the activities that are performed for ordering, receiving, paying for the invoice, picking, packing, delivering, billing and collecting. But you make less gross profit dollars for it if you neglect to price right when you get a lower cost. In this way you can unknowingly kill your profits.

The Two Major Ways To Kill Profit With A Lower Cost

Okay, so you negotiated a better deal on nets into stock. Or you got a better into-stock multiplier than you believe was made available to competitors. Or, you negotiated a better SPA deal for the contractor or industrial market. You sit back and tell yourself you’re in store for a heap of gross margin improvement. Ah, but you might have forgotten a couple of very important things. It’s all what you do with that cost that counts.

1. If you use the same markup matrix on the lower cost, you make LESS Gross profit dollars. For example, 25% gross profit on 90 cents of cost is less than 25% gross profit on a dollar of cost.

2. If your people see the cost, and see the gross profit rate on the new cost, they might freak out and override the price even if you do adjust your matrix.

The cure for these problems can be found right in the statements about them.

Making Matrix Pricing Work With a Lower Cost

Matrices are rows and columns that contain “cells.” A cell contains a markup or a gross profit rate that is applied to a “cost.” Most systems allow for more than one “cost” figure. It’s your choice as to which one you use for setting a price. So why use the lower one to set a price when you believe you have a competitive advantage with the pricing you just negotiated? Why not send some and sometimes all of that cost advantage to profit, instead of doing what the Chili Peppers sing about: “Give it away, give it away, now!”

How do you do it? Well, we’ve done it with distributor business systems so we’ll share that wisdom. The matrix stays the same, but it can be directed to use the higher of two cost numbers. The higher cost can be referenced to a normal distributor net cost, or the list price with your “normal” multiplier applied. You need to engineer each product “buy line” this way and sometimes each SKU when it comes to special nets into stock.

Too much trouble, you say? Okay, then just “give it away.” It’s only money. There’s plenty of volume out there to get, and you’ll make it up on volume, right? While it’s theoretically possible but highly improbable that you could make up the lost gross profit dollars with volume, you would certainly impair your rate of net profit. We’ll explain.

Here’s an example.

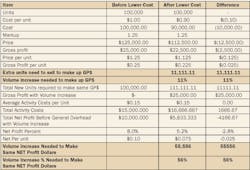

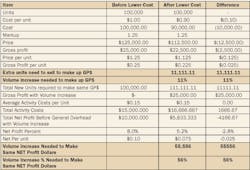

To make up the $2,500 in gross profit dollars, he would have to sell 11.1% more. But that’s not the whole story. There are costs associated with higher physical volume. Let’s say those costs are 15 cents a unit. When these activity-based costs are considered, getting a 10% lower cost and giving it all away requires a 56% increase in physical volume to make up the net profit. And your rate of net profit still suffers. Stunning? It’s real. So be very careful how you price when you get a lower cost!

Ways to Get the Lowest Cost Possible

Okay, nowwe will talk about how to get the lowest cost, since we’ve given you the wisdom on how to keep most of it as profit.

1. Monitor competitive pricing levels and store in a database. Train salespeople to report situations, and put up a web form on your intranet and collect dates, whether it was a discount on an SKU or a product line, the discount or price level, the customer, distributor and manufacturer or the market. Also note the situation: a job quote, annual requirements or a blanket agreement with a contractor for supply items. There’s nothing like proof when you sit down with a manufacturer to get what you need.

2. Monitor the Big Box pricing weekly. In the past, we monitored Lowe’s and Home Depot prices in the papers, websites and went directly to the local stores once per week and recorded prices on specific SKUs. We even took pictures with our smart phones. Again, proof is worth its weight in gold.

3. Sit down with manufacturers and ask about all SPAs and special nets that are available.

a. Regularly share your intelligence with manufacturers. Help them make a good decision to deliver a lower cost so you can be competitive. Make them aware that you are not trying to depress price in the market but are trying to make the most profit and will not simply give it away where you don’t need to.

b. Get everything you can from an SPA. Some may apply to specific customers. Others may apply to markets, so you can claim on any sale to any customer in a market segment, like SPAs written for all contractors, another for manufacturers, or one for OEMs. You have to do a little more work to price differentially where you don’t need to give as much away, but it’s worth it. If the manufacturer lets you claim on all sales to customers that qualify for a market SPA, why not do it? Price with profit in mind.

c. Determine whether special nets to stock or SPAs will work better for you in terms of generating profit. This usually depends on how easy it is to implement either one in your ERP system. Also, once you buy something at a net, if the market price changes, you’re stuck with it. SPAs can be changed or a new one written if the competitive level in the market changes.

Should Sales People See Cost?

We’re going to give you a consultant’s answer here: It depends.And you can probably answer this one for yourself, because it depends on the maturity, intelligence and experience of the salesperson. It also depends on whether your business system will allow you to set permissions to override prices and see true costs for each system user. Then you have to train salespeople to refrain from sharing their privileges. If you can do all that, and trust certain salespeople to price intelligently, the answer is “yes.” If not, the answer is an emphatic “no.”

We will state the obvious here once again. Price has the number one impact on your bottom line. Distributors allow salespeople far too much leeway with pricing without the proper education or ability to handle pricing intelligently. Most are customer pleasers, not boss pleasers. So the answer here is “please yourself.”

The right approach to pricing is a combination of getting the lowest cost, pricing with profit in mind so you don’t give it away, using all the capabilities of your system to manage this, and educating everyone involved with pricing on how to do it well.

It’s a beautiful thing when it works this way. Like Hannibal, the cigar-smoking leader of the “A-Team” used to say, “I love it when a good plan comes together.”

Allen Ray has 45 years experience as a distribution business owner, information systems, marketer of product data and consultant to wholesale distributors. Allen advises clients on strategies to stop profit leakage and boost growth readiness. Contact Allen at [email protected].

Neil Gillespie is a veteran distribution consultant, speaker and author. Neil helped Roden Electrical Supply of Knoxville to grow more than 500% over 11 years while more than tripling EBITDA percentage. His book, Discover Your Core, Then Go For Moreis available on iBooks and Amazon.com. Contact Neil at [email protected]

About the Author

Allen Ray 1

Allen Ray has years of experience as a distribution business owner and in information systems. He has also been a marketer of product data and is currently a consultant to distributors, advising clients on how to stop profit leakage and grow their bottom line. You can contact him at [email protected].