Sponsored

To align your business with what your customers are expecting from the year ahead, the best bets will be to focus on energy-efficiency, safety, and labor-saving products — particularly those suited to renovation and retrofit applications. There will be growth, but don't look for massive expansion in any category.

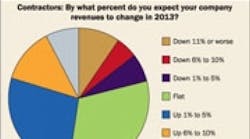

Distributors' customers do see cause for some cautious optimism in 2013. Life is still tough for electrical contractors in many markets, however. Expectations of aggregate growth just under 1% among contractors and 3.4% growth in electrical materials purchases among end-users would be considered anemic in a stronger economy. But certain market segments and product categories offer opportunities to improve on those aggregated numbers.

As part of an ongoing series of studies to explore the expectations and experiences of electrical distributors' primary customer groups, Electrical Wholesaling and Channel Marketing Group, Raleigh, N.C., surveyed readers of sister magazine Electrical Construction and Maintenance (EC&M). This time around, in a survey we sent in Dec. 2012, we asked a variety of questions about expectations of 2013 sales growth in various categories and solicited insights on how distributors can help their customers grow business.

From the 50,000 EC&M readers we sent survey invitations, we received over 500 completed surveys in time for our analysis, enough to draw some solid general conclusions. Over half of the respondents were electrical contractors (50.3%), followed by engineers and architects (14.9%), industrial end-users (9.3%), educational (6.3%), government (5.3%) and smaller numbers among a smattering of other categories. Respondents were fairly evenly distributed across the continental United States.

We asked everyone who took the survey, “What is your most pressing electrically-oriented issue as you look to 2013?” In response, many contractors said their main concerns are cash flow, finding enough work and getting paid for the work they do. Many mentioned there was too much competition for too little work.

Even among those who can find enough work, there is widespread concern about the ability to find enough skilled workers. “Finding qualified help that wants to work,” Tobias Sommer, president of Advanced Electrical Services, a contractor in Omaha, Neb., said. “The amount of new apprentices coming in to replace the aging workforce is way down. Younger apprentices are hard to find and when you do they want to make a ton of money and not work hard for it.”

Nick Schaeffer, president of ElectricMan, Inc., Dallas, had a similar take: “Finding talented electricians who can meet my standards. A lot of people are happy being on unemployment since it is a long-term option. This is my issue since my work load is strong.”

Other issues that were on a lot of respondents' minds included arc-flash mitigation, materials costs, and keeping up-to-date on the latest technologies.

Contractors are looking for the biggest growth in renovation work and energy-efficient retrofits in 2013. End-users such as plant maintenance people, engineers and electricians have a widespread interest in arc-flash mitigation and other safety technologies as well as energy efficiency.

Across all groups, the leading product priority is to stay abreast of the latest in solid-state lighting.

For Arthur St. John with PLANT Engineering Consultants in Colorado, the top electrical issue on his mind for 2013 is, “Energy-efficient lighting and lighting controls. We are seeing significant interest from owners in LED lighting mainly due to reduced maintenance costs. Our electric utility rates are low so reducing the maintenance hours is a primary driver.”

Labor-saving products and arc-flash mitigation were other product areas that respondents said would be important to them in 2013. Solar power ranked just ahead of building automation; both were followed closely by lighting audits, safety and security products, data/communication products and energy audit services.

Contractors

There is cause for concern about the outlook among contractors. When asked how many months of work they had on the books to start the year, a substantial 26.9% answered, “none.” The largest number (44.9%) said they have 1-3 months booked. Another 15% have 4-6 months and 10% are booked more than nine months ahead.

Broken down by market segments, even the best markets suggest weak growth. Contractors ranked home renovation/remodeling/service as the best prospect for 2013 growth, but by our weighted ranking, even this market falls into the “weak growth” category nationwide, scoring 3.27 points on a five-point scale:

-

Decline

-

Flat

-

Weak Growth

-

Moderate Growth

-

Strong Growth

Commercial/office renovation came next at 3.03 points and health care at 3.02 points, followed by commercial construction (2.91) and data centers (2.87). Industrial construction, petrochem (including oil and natural gas) and retail construction all project the same growth rate at 2.83 and government construction is just a tick behind at 2.82. Single-family and multi-family housing both posted a 2.76 rate, ranking them as “flat to weak” markets.

Distributors Can Help

Asked how distributors can help them achieve their goals, there were the expected requests for lower prices, easier credit terms and free equipment, but some of the more realistic comments involved faster turnaround on quotes, carrying more inventory, offering better online ordering systems so customers can put together quotes and orders after hours, providing more training and hiring more qualified counter help. Many also emphasized the need for accurate pricing and avoiding surprises when commodity prices change.

Electrical distributors' customers expressed a desire for better technological support such as more convenient online ordering from their distributors.

“Provide a user friendly interface for online ordering along with a discount for ordering online. Drop ship is OK. Time spent at wholesalers is wasted and excessive,” said one respondent who didn't give approval to use his name.

As one respondent suggested, distributors who know how to sustain a partnership with their customers will have an ally through thick and thin. “Truly partner with my company to allow both of us to survive the current economic downturn so we are both available to capitalize once the economy returns.”

David Gordon, president of Channel Marketing Group, Raleigh, N.C., will be offering expanded analysis of the results from this survey to his clients and for sale to others. He can be reached at [email protected] or 919-488-8635.