Electrical Wholesaling’s annual survey of the Top 200 electrical distributors always offers one of the electrical market’s best spot checks on the economic health of the industry at mid-year. And as you might expect in a year where business prospects vary so wildly from metro-to-metro and niche-to-niche, one’s sense of the market climate will depend on with whom you speak.

At a time when many distributors would be happy with growth somewhere in the industry’s historical range of 4% to 8%, a surprising number of respondents to this year’s survey — 23 of 118 (19%) — expect double-digit sales growth in 2016.

Mark Doris, president, Mars Electric Co., Willoughby, Ohio, is expecting a 10% increase in sales and says healthcare and senior-living facilities are showing strong growth. Brad McCormick, CEO, Electric Supply & Equipment Co., Greensboro, N.C., is seeing mixed business prospects and has adjusted his forecast down a few points to -10%. While the tire/ rubber market is showing growth in his region, consumer products companies are down. “Customer capital spend was up for 2015. They were choosing to automate the manufacturing facilities,” he said.

One wire and cable specialist said the decline in copper prices and the slowdown in the industrial market affected his company’s 2015 sales. Jeff Siegfried, president and CEO, Omni Cable Corp., West Chester, Pa., is looking at flat sales growth in 2016 and possibly a slight decline. “Industrial is tough, really tough,” he wrote in the survey. Despite the tough market, Siegfried is investing for future growth and recently opened a new Omni warehouse in Kent, Wash.

Anixter International, Glenview, Ill. said the decline in copper prices had a big impact. Its 10-K said “an unprecedented decline in commodity prices,” and the strong U.S. dollar, soft emerging markets and growing weakness in the industrial sector combined to create a nearly $300 million unfavorable impact to reported sales, with its Electrical & Electronic Solutions business unit getting hit hardest.

At least two electrical distributors based in Texas seem to be bucking the trend of slow growth in the Gulf Coast oil patch. One company is looking at a 10% increase in sales and has opened several new branches. Buddy McCulloch, president, Wholesale Electric Supply, Texarkana, Texas, says industrials are showing growth. His company opened locations in Vicksburg, Miss.; West Monroe, La.; and Gainesville, Texas. David Gardner, president, Mission Controls & Automation, San Antonio, Texas, expects sales to be up 5% to 7% despite the oil market and sees growth from the food and beverage and wastewater treatment segments. The company was also recently awarded Tier 1 status by Toyota.

Another distributor in the oil patch, The Reynolds Co., Fort Worth, Texas, is expecting a flat year, and said the energy downturn has impacted other markets in its region and will challenge the local economy in the short-term. However, Walt Reynolds, company president and CEO, believes the oil business will start to improve in the second half of 2016. “Oil and gas continues its slide, but we see that leveling off and coming back third and fourth quarter,” he said. “Commercial construction has its bright spots.”

Several Michigan distributors that serve the auto industry had bullish forecasts, but none more so than Daniel Bemis, CFO of Caniff Electric Supply Co. Inc., Hamtramck, Mich., who expects a 20% sales increase — $7 million in new sales — pushing his company’s revenues to $40 million from strong auto industry and commercial new construction. Says Bemis, “We have hired 16 people in the past one-to-two years that have helped us gain new business from new customers and existing customers.”

Methodology. To compile this listing, in April of this year EW’s editors sent out a survey to several hundred distributors of electrical supplies that have either been on the list in the past or have at least $10 million in annual sales, according to our data sources.

In addition, we get data from publicly held distributors and other companies that make their sales and company data public. This year we got 2015 sales information on 126 Top 200 distributors, which is quite a bit lower than in recent years. We think the lower response rate is due in part to the uptick in acquisitions and the tough business year some distributors had last year.

Many of these companies ask us to use their sales data confidentially and only for placement on the listing. You will also notice that we rank some companies that have been acquired in either 2015 or 2016. Our general rule of thumb here is that when a company has been acquired, we include their sales (or a sales estimate) for that calendar year, but take them off the Top 200 listing the next year, when they are fully integrated into the acquirer.

In those situations where a distributor is large enough to make the listing but did not respond to our surveys, if we have reliable sales or employee data from the past two years, we will estimate their sales using the sales-per-employee average calculated from data collected from other Top 200 respondents. This year 106 full-line distributors provided both sales and employee data, and the 2016 sales-per-employee figure is $634,791.

Strictly by the numbers. With an estimated $65.2 billion in North American sales, EW estimates the Top 200 distributors controlled approximately 65% of sales through electrical distributors in North America. According to EW estimates, these 200 companies employ at least 88,082 employees and run at least 7,257 North American branches. The employee and branch data include an estimate for Sonepar’s employee count in North American and does not include North American employee counts for Anixter, Grainger or Fastenal (listed for the first time this year) because these companies do not break out employee data by their electrical segments.

It’s interesting to note that Fastenal Inc., Winona, Wis., which depends on sales of electrical products for 4.7% of its $3.87 billion in 2015 sales, has almost as many branch locations (2,320 locations in the U.S. and Canada) as the five largest full-line electrical distributors in North America combined (2,830 locations) – Sonepar, WESCO, Graybar, Rexel and Consolidated Electrical Distributors.

SIDEBAR: WHAT’S NEW WITH THE TOP 200 DISTRIBUTORS?

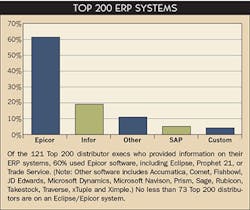

Quite a few Top 200 distributors are in the midst of major growth initiatives. Some are installing or planning to invest in new ERP systems, or updating their existing systems, like Candela Corp., Irvine, Calif.; Caniff Electric Supply Co. Inc., Hamtramck, Mich.; City Electric Co. Inc., Syracuse, N.Y.; Kovalsky-Carr Electric Supply, Rochester, N.Y.; Raymond deSteiger, Sterling Heights, Mich.; St. Louis Metro Electric Supply Inc., St. Louis, Mo.; Standard Electric Co., Saginaw, Mich.; and VEC Supply, Charlottesville, Va.

Sunrise Electric Supply, Addison, Ill., was one of many companies beefing up its online presence. Jim Sobecki, CIO, said the company will be focusing on a variety of technical initiatives in 2016. Sunrise has updated its website to freshen up its online presence, added online ordering, and may implement a document management system.

Other companies were building new headquarters facilities, branches and central distribution centers (CDCs). CBT, Cincinnati, is celebrating Jim Stahl’s 40th anniversary of ownership with a move to a new 100,000-sq-ft headquarters in July. Mitch Lane, CEO, Echo Group, Council Bluffs, Iowa, said the company built and opened a new location in Sioux City, Iowa, is currently building a new location for its Council Bluffs, Iowa, branch, is moving to a new corporate headquarters and added a third location in Des Moines, Iowa. Standard Electric Supply Co., Milwaukee, is building a 25,000-sq-ft addition to its headquarters; Werner Electric Supply Co., Appleton, Wis.; opened a new distribution center; Western United Electric Supply Corp., Brighton, Colo.; built a new test lab in Colorado and opened a new warehouse in Colorado; and Tri State Supply Co. Inc., Washington, Pa. opened a new CDC.

Elliott Electric Supply, Nacogdoches, Texas, and Graybar Electric Co., St. Louis, two of the electrical distributors who have added the most branches over the past few years, didn’t let the uncertain economic environment stop their branch expansion programs. Elliott Electric opened locations in Tulsa, Okla.; Georgetown, Texas; Covington, La.; El Dorado, Ark.; Magnolia, Ark.; and Roswell, N.M. Graybar opened branches in New York, N.Y.; Orem, Utah; Watford City, Md.; Fort Worth, Texas; and Grand Forks, N.D.

Some distributors were investing in other areas of their operations. Phil deLoache, operating partner and president, First SOURCE Electrical, LLC, Houston, said his company is building a specialty group focused on the lighting and gear for multi-family and high-density housing projects. “This has proved to be a good investment and we’re in the process of moving this business into a new 26,000-square-foot facility which will be our first branch,” he said.

Graybar said the strategic investments it’s making in new locations, and expanding and developing its sales force, e-commerce and mobility has helped it outperform the market, and Greg Knowles, president and CEO, Autonomy Technology Inc., Las Vegas, says his company is “more strategically focused” and is building on its strengths in the automation market. “We are reinforcing what we are great at in the markets closest to our locations. We are centralizing our sales force, moving away from work from home to a more collaborative work environment.”

EDGES Electrical Group, LLC, San Jose, Calif., a partnership launched last year between Electrical Distributors Co, Inc., of San Jose and Granite Electrical Supply Inc., Sacramento, Calif., is in expansion mode, with a new branch in San Leandro, Calif., and new opportunities created by the merger and the strong Bay Area marketplace. “We have substantially increased our footprint due to our newly created partnership. Additionally, we’ve seen tailwinds due to improving economy,” said David Ahady, senior accountant.

In other news at Top 200 electrical distributors, Schaedler YESCO, Harrisburg, Pa., is sole sourcing Eaton gear in eight of its western Pennsylvania branches, The Hite Co., Altoona, Pa., invested in its distribution center, including the installation of a centralized wire cutting operation; K/E Electric Supply, Mt. Clemens, Mich., implemented an enhanced purchasing system that took more than three years of on-site work to develop; Wildcat Electric Supply, Houston, will launch a new E-Commerce and online portal this month; and TEC Manufacturing and Distribution Services, Georgetown, Texas, was named Distributor of the Year for GE’s Prolec Transformers group based on power unit sales.

We also must mention a number of big anniversaries for Top 200 distributors. Butler Supply, Fenton, Mo. (75 years); General Pacific Inc., Fairview, Ore. (50 years): Glenbard Electric Supply Inc., Lombard, Ill. (50 years); JH Larson Electrical Co., Plymouth, Minn. (85 years): KJ Electric Corp., East Syracuse, N.Y. (35 years); Metro Wire & Cable, Corp., Sterling Heights, Mich. (40 years): Peninsular Electric Distributors, West Palm Beach, Fla. (70 years); Tri-State Utility Products Inc., Marietta, Ga. (60 years); and Wholesale Electric Supply, Texarkana, Texas (70 years in 2017).

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.

Doug Chandler

Senior Staff Writer

Doug has been reporting and writing on the electrical industry for Electrical Wholesaling and Electrical Marketing since 1992 and still finds the industry’s evolution and the characters who inhabit its companies endlessly fascinating. That was true even before e-commerce, LED lighting and distributed generation began to disrupt so many of the electrical industry’s traditional practices.

Doug earned a BA in English Literature from the University of Kansas after spending a few years in KU’s William Allen White School of Journalism, then deciding he absolutely did not want to be a journalist. In the company of his wife, two kids, two dogs and two cats, he spends a lot of time in the garden and the kitchen – growing food, cooking, brewing beer – and helping to run the family coffee shop.