While better times are ahead for the electrical industry, it’s important to note that in 2016 total industry revenues were negative for the first time since the Great Recession.

As far as industry recessions go, this one was mild. Unlike the electrical industry, the overall U.S. economy did not experience negative growth. The difference is that the electrical industry is in its own economy, not the general economy. That said, the overall economy came close to negative growth in 1Q 2016. U.S. GDP grew only 0.8% in that quarter, and at the same time, total electrical industry sales experienced -0.9% growth. The worst was yet to come, with industry revenues down 2.7% in 2016’s second quarter, led by a sharp -4% decline in the distributor-served industrial market.

Let’s not dwell on the electrical market’s 2016 declines, because the industry’s growth prospects look much brighter in 2017. There are better times ahead. We don’t have all the 1Q 2017 economic data in yet, but I believe industry sales gained nearly 3.5% in the first three months of 2017.

The fundamentals are in place for electrical industry revenues to advance +6% this year. That’s a pretty good “pop” coming out of a recession. By comparison, it took two full years for the industry to recover from the Great Recession. Industry sales were down 24% in 2009, but came back in 2010 with only a 3% recovery. It took another year for the industry to roar back, up nearly 10% in 2011.

It is unlikely that we will have another “Great Recession” in the next few years. But it’s equally unlikely that we will have another growth spurt to the tune of 10% as we go forward through this industry business cycle. We could build a whole scenario about family formations, consumer confidence, the stock market, rig count, and the Fed’s inching up the federal funds rate, but it’s more important to focus on the economic drivers that have the most impact on the electrical market.

KEY ECONOMIC INDUSTRY DRIVERS

Let me cut right to the chase. First, after two years of “deflation” in the electrical industry, we are finally seeing some interesting price gains. That’s revenue in your pocket. Second, and this is big, after two years of negative growth, nonresidential construction will jump nearly 6.5% this year.

Two factors are now driving this rebound from negative growth in 2015-2016. One is that continuing, and significant, gains in office building construction will drive commercial construction up nearly 10%. And second, a sharp rebound in mining and exploration spending — up 34% this year — will add to the strength in nonresidential construction.

That performance speaks to large metro areas and the “oil patch.” We expect those areas will be the underlying strength for industry performance this year. In residential construction we do not see anything resembling double-digit growth over the course of our business cycle. Low single digits will be the growth track taking us through 2020.

Business spending for communication equipment is big business and it invariably spills into the electrical industry. We expect investment in communication equipment to gain nearly 16% in this year’s second quarter, with a solid 8.5% increase for the year as a whole. And you can definitely look for growth in the contractor market and nonresidential business.

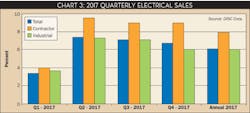

Wrapping up, DISC is forecasting the kind of industry strength we haven’t seen in five years. We believe industry sales in 1Q 2017 will increase less than +3.5%. But from here on out, during the rest of 2017 we are looking for quarterly gains averaging better than +7%.

I think you will find the quarterly chart on this page particularly interesting because it shows the trajectory of how we see industry performance behaving this year. We see a nice comeback in the distributor-served industrial market, but it’s the contractor market that will mainly drive industry sales this year. As you view these two major industry segments, think in terms of large metro areas and the Permian Basin. Those are not the only opportunities but they are certainly quite visible.

If you have any questions about DISC’s subscription-based data services, contact Herm at 203-799-3673 / [email protected].

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.