Sponsored

Much has been projected, written and said about e-commerce over the past few years. To get the customer perspective, Channel Marketing Group contacted electrical contractors, facility maintenance personnel and other electrical buyers to ask what they thought about e-commerce. Our “2018 State of E-commerce Electrical Contractor and Buyer Insights” report shares the findings of this outreach. The study answered the following questions:

- Are electrical distributors’ customers using e-ordering tools such as online ordering, EDI, e-procurement systems and more?

- If they are purchasing online, how much and from where?

- How do they use the web and/or distributor sites?

- What attributes do they expect on a website?

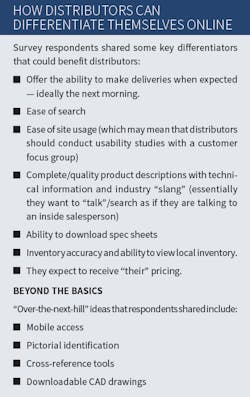

- What will differentiate one site, and one distributor, from another?

- Where do they see e-commerce going?

While 80% of the end user respondents said they believe e-commerce is the future, many also said there is a role for inside and outside salespeople. The transactional aspect of completing an order may occur electronically, but they aren’t convinced that amazonbusiness.com, grainger.com or any other site will completely serve their needs. Additionally, customers believe “being local” adds value. So, there is hope for distribution. Customers think that as more distributors launch websites, their perceived competitive inability to compete versus online sources diminishes. The web provides transparency in pricing, enabling electrical buyers to use the information locally.

From a manufacturer viewpoint, the findings of this Channel Marketing study provide insights into potential electronic e-channel strategy development, highlight the need for quality product content that’s robust and differential, and the need to build brands and market themselves. Further, distributors may launch tools to enable manufacturers to market themselves on their websites, similar to what is available through sites like Amazon Business.

Talking to Electrical Buyers

In “The E-Commerce Investment” in last month’s issue of Electrical Wholesaling (February 2018), we shared some of the insights we gathered from electrical distributors. While it’s interesting to have the channel perspective, it’s even more important to understand and interpret customer needs, expectations and to read between the lines to identify the unmet needs. Electrical distributors frequently conduct research by talking to a few of their best customers, copying competition, asking their friends or maybe their salespeople, or pursuing an initiative based upon their observation and intuition. And once the initiative is launched, it’s benchmarked versus company performance rather than seeking industry benchmarks and confirming value or needs with customers.

Over the past few years, as Amazon expanded from B2C (business-to-consumer) into the B2B (business-to-business) space, some industry observers have said distribution is doomed and would be relegated to serving product categories and applications with a high cost to serve (heavy commodities, projects and applications that require expertise, and where it’s questionable if the customer would pay a fee as they are used to bundled pricing.)

Survey Demographics

The survey was conducted in late 2017 and over 1,300 electrical buyers shared their usage, insights and expectations. Additionally, over 50 buyers participated in more in-depth discussions with us. Respondent demographics approximated industry sales, with almost 40% being contractors, 36% were industrial and OEM customers, 10% were employed by institutional facilities and the remaining 14% being “other” which could include engineers and other influencers. A few distributors shared the survey with their customers, Electrical Wholesaling reached out to EC&M subscribers and Channel Marketing Group used a proprietary list. Here’s a top-line look at the key customer feedback:

- They use online purchasing. Although online (website) ordering is low as a percent of sales they see this segment growing.

- The industry average is 4% of customer purchases and it differs by customer segment.

- While Amazon is a recipient of sales, it’s not necessarily the largest or only.

- Of those who purchase online, they use websites extensively for product research, spec sheets, checking pricing and verifying inventory.

- Online ordering typically ranks #5 out of six online activity categories.

- For those who do not purchase online, it’s because they prefer to talk with a salesperson and/or their admitted “old habits.”

Customer Online Activity

Forty-five percent of overall respondents said they purchase some electrical material online. Of the respondents who do purchase online, 54% purchase less than 10% of their material needs online. While the percent may be surprising, consider if distributor salespeople are proactively asking their customers if they are purchasing online. They frequently don’t ask and mistakenly assume customers are not. Some of the purchasing is occurring through MRO distributors such as Grainger, McMaster-Carr and others; some through Amazon Business, Automation Direct and other niche product sites; and some through e-tailers/e-distributors such as Home Depot and Lowes’ websites, Zoro, and a number of online lamp companies. And yes, some through electrical distributors.

Remember that many distributors have “antiquated” but functional web-order entry systems that distributors launched through their ERP companies. They may not be as functional as the latest e-commerce systems, but for customers who got used to those ERP systems, they are still sufficient and they know how to use them. Within the industrial and institutional segments, e-procurement systems such as SAP, Coupa, Ariba and others are popular.

Amazon Business

Respondents are purchasing from Amazon Business. Their penetration rate does differ by customer segment, but given the online purchasing penetration in this industry it appears that purchasing through Amazon Business is not a repetitive/habitual activity for electrical buyers. In speaking with contractors and industrial MRO buyers, it became apparent that their Amazon Business activity is more restricted to difficult-to-find items they are sourcing and non-technical items they know will not need to be returned or for which they will not need advice. Contractors related challenges in receiving deliveries where needed (i.e. jobsites) as well as in handling returns.

Amazon Business is used for pricing given its transparency. However, a few MRO customers said, “Price is not the #1 or only consideration. We’re more focused on competitive pricing and product availability/ability to deliver.”

The continued evolution of Amazon Business to now provide project pricing as well as its ability to integrate with 50-plus procurement systems highlights how the company can learn and compete. Amazon provides a platform to be an ordering and fulfilment center or a marketplace. In both cases, others are enabling it to be an industry competitor. As a respondent said, “They accept orders, they don’t sell or provide service.”

Future Use of E-Commerce

When asked, “Longer term, how do you see e-business/e-commerce (electronic estimating, online ordering, online collaboration, smartphones, etc.) affecting your business and your electrical material needs?” 80% said e-commerce is part of their future and they foresee increased usage. Some see e-commerce facilitating essentially just-in-time order fulfillment. They say, “As viewing local stock and delivery times on all our inventory items becomes easier to do, we will stop stocking to reduce overhead and purchase items as needed. This will change things from bulk orders to constant micro transactions due to our space limitations.” And with the emergence of the IIoT (Industrial Internet of Things) you can see the day when sensors could enable instant ordering for MRO materials from preferred distributors.

While others focus on the product data aspect, the availability of comprehensive, up-to-date information will become more and more important. Some respondents said it will determine where they place orders. This product data can be inventory information as well as positioning a distributor as more than a material aggregator but also an information aggregator.

We learned that the role of the salesperson is not dead. Said one respondent, “E-commerce will continue forward. This process shall not eliminate our local salesperson. A lot of companies we have used in the past go to the Internet and eliminate their local salespeople. In turn, we have dropped our purchases from them drastically. You have to have the human connection with your buyers.”

Another factor to consider is that online tools make life easier for small contractors and may enable distributors to more profitably serve these accounts. Said one contractor, “We are a small contractor and often work nights and weekends finishing up proposals and estimating, so having pricing and ordering available online is important to us.”

Conclusion

Many mid-size and large distributors have invested heavily in people, time and capital to launch and manage their e-commerce sites. While the return on investment to date for most is minimal if any, customers will expect the distributor of tomorrow to provide them with online access. Whether orders originate on the web, are communicated through other means electronically or are sent in via carrier pigeon, most distributors are ambivalent as long as they are profitable. The key is providing customers with an omni-channel experience.

Electrical sales leakage will occur as there are more entities competing for electrical distributors’ customers. Similar to when big boxes entered the market, a percent will get siphoned off. The size is unknown at this time but a web presence is needed, at worst case, for customer retention.

Tools are available for small and mid-sized distributors to compete cost-effectively. With 80% of electrical buyers in the survey saying this is the future and 45% already purchasing some electrical material online, accelerating deployment is essential. Your customers are already searching for electrical material and buying online.

Note: This full report is available by contacting David Gordon at [email protected].