The Electrical Market By the Numbers - September 2025 Update

Key Highlights

- The Architecture Billings Index indicates declining demand, signaling potential slowdown in nonresidential construction activity.

- Electrical manufacturers report increased shipments and new orders, reflecting ongoing industry strength despite economic headwinds.

- Housing starts saw a slight monthly increase, but permits declined, pointing to mixed signals in residential construction.

- Electrical Price Index remains above historical averages, raising concerns for contractors reliant on housing market growth.

- Employment in electrical contracting remains robust, with over 1 million employees for several months, indicating industry stability.

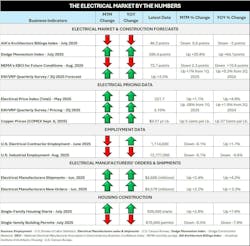

Electrical Wholesaling’s new Electrical Market By the Numbers analysis for Sept. 2025 seems to reflect many of the economists’ prognostications you hear right now about the U.S. economy. In a word, it’s “Meh” – rather uninspiring and unexceptional -- nothing pointing toward great growth far into the future, but no flashing red lights signaling an imminent downturn or recession.

As with many statistics, you could pull what you want from the 15 monthly and quarterly indicators in our Electrical Market By the Numbers, and spin things a variety of different ways, because they often tell both a positive and negative story. Let’s take a look at some of this month’s key indicators.

Electrical Market & Construction Forecasts

There is a real mix of indicators in these forecasts. The least-bullish of them is the Architecture Billings Index (ABI) published monthly by the American Institute of Architects (AIA) and Deltek, which surveys architects to predict nonresidential construction activity nine-to-twelve months out. This index is showing declining demand for architects’ services on both a month-over-month and year-over-year basis. For July, it stands at 46.2 points, which is under the 50-point mark indicating growth.

But for every sour statistical story in this month’s data, you can find some reasons to cheer. The National Electrical Manufacturers Association (NEMA) publishes its monthly ElectroIndustry Business Confidence Index (EBCI), a monthly survey of senior managers at electrical manufacturers. While the EBCI’s future conditions component was down in August on both a month-to-month and year-over-year basis, it’s still comfortably above the 50-point mark indicating improving business conditions.

Another positive indicator is the Dodge Momentum Index (DMI), a monthly measure of the value of nonresidential building projects entering the planning stage shown to lead construction spending for nonresidential buildings by a full year. It was up +20.8% in July.

Electrical Pricing Data

If you are freaked out by an Electrical Price Index that’s currently riding quite a bit over its historical averages on a monthly (+0.2% monthly average) and annual (+2.6% annual average ), you can find reason for concern, as could electrical executives who depend on single-family housing construction, when they see permits down -7.9% YOY through July. The Electrical Price Index is published each month by Electrical Marketing newsletter and is available as part of a $99 annual subscription. Go to www.electricalmarketing.com for details.

Employment Data

While electrical contractor data was down fractionally in the most recent data, it’s still on a historic run by registering another month over 1 million employees. It hasn’t been below this mark since January 2022, according to data from the U.S. Bureau of Labor Statistics.

Electrical Manufacturers’ Orders and Shipments

Shipments and new orders are both solidly in the green in June, with shipments up an healthy +4.3% YOY to $4,606 million and new orders up +3.3% to $4,579 million. They were both up in the +2% range over May. Electrical manufacturers have got to be reasonably pleased with these numbers.

Single-Family Housing Construction

While the challenges homebuilders are facing with high interest rates, a smaller cohort of first-time home buyers because of demographic realities and issues with local building restrictions are well known, the latest data was positive for housing starts with a +2.8% monthly boost in July to 939,000 single-family starts and a +7.8% YOY increase over July, 2024. Building permits, the better leading indicator, wasn’t as positive with a -0.5% decline in single-family building permits to 870,000. That’s -7.9% below the July 2024 data.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.