What will you remember about 2025? Tariffs? AI? Data centers? The sluggish economy? Electrical Wholesaling’s editors pegged these topics as key trends shaping the electrical market this past year and came up with six others. Check them out below.

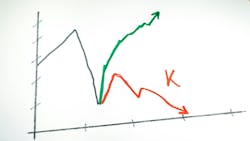

#1. The opportunities and challenges of the U.S.’s K-shaped economy surface in the electrical market

In 2025, we learned about two new economy terms – the “K-shaped economy” and “bifurcation” (the division of something into two branches or parts).

Right now, only the most pessimistic economists are calling for an outright recession in the United States, but many, if not most, will bend your ear about the “K-shaped economy,” where some segments of the overall economy are doing very well while other sectors are struggling to grow.

The electrical construction industry is a good example of the K-shaped economy in action. Riding the upper growth arm of the “K” is the data center market (growing annually a high double-digit growth rate). Hanging onto the lower leg of the “K” with little or no growth are many other key construction market segments, such as residential and office construction and much of the industrial market (outside of semiconductor plants).

These “bifurcated” market conditions are likely to last through most of 2026, although the federal tax cuts that take effect next year (and any further cuts in interest rates) should juice up capital spending on new construction and renovation projects and make residential mortgages more palatable for many homebuyers, stimulating home construction.

#2. A comparatively quiet year for distributor acquisitions, but a flurry of rep acquisitions make headlines

Electrical Wholesaling’s editors can’t remember a year when electrical distributors made fewer major acquisitions (see chart). By our count, the only distributors acquired from the 2025 Top 100 ranking were Swift Electric Supply, Teterboro, NJ (Monarch Electric/ USESI/CED); Warshauer Electric Supply, Tinton, Falls, NJ (Rexel USA); and Schwing Electrical Supply Corp., Farmingdale, NY (Rexel USA). Rexel USA’s purchases of Schwing and Warshauer added some major clout in the New York metropolitan area. The comparatively light M&A activity comes after a super-busy year in 2024, when at least 12 Top 100 distributors were acquired.

Interestingly, it was independent manufacturers’ reps in the headlines this year with their acquisitions. One rep that has been particularly active on the M&A front is JD Martin Co., Houston, TX. It has acquired eight rep firms since 2018, including this year’s mergers with Utility Agency & Import (UAI Reps), Mansfield, TX, and WindShine, Oklahoma City, OK. JD Martin previously joined forces with the Schell Co., Mandeville, LA; Centauri Sales, Albuquerque, NM; I-Pro, Wheat Ridge, CO; Broomfield Lamb Holman, Loganville, GA; Integrated Component Sales (ICS), Winter Park, FL; Rhodes Electrical Sales, Bartlett, TN; and Vynckier Enclosures.

Three other big rep M&As were the moves by Bell & McCoy Companies, Houston, TX, to acquire Bob Jones & Associates, Phoenix, AZ, and the merger of Yusen Associates and A.A. MacPherson, two of the largest independent rep agencies in New England and upstate New York; and the giant lighting rep SESCO Lighting’s purchase of NEXGEN Lighting Solutions, Carrollton, TX.

#3. Electrical manufacturers build data center capabilities through acquisitions

It probably shouldn't come as a surprise that many of the 2025 manufacturer acquisitions involved companies acquiring firms with a specialty in the data center market.

These acquisitions included Littelfuse’s acquisition of Basler Electric, Highland, IL, a manufacturer of electrical control and protection solutions for grid and utility infrastructure, power generation and data centers; Legrand’s acquisition of Avtron Power Solutions, Cleveland, OH, a manufacturer of load banks and power quality solutions for data centers and other critical applications; Hubbell’s purchase of DMC Power, Carson, CA; a provider of high-voltage connectors; the Eaton acquisition of Resilient Power Systems, an Austin, TX-based provider of solid-state transformer technology and other energy solutions and its purchase of Fibrebond, an enclosure manufacturer based in Minden, LA; and ABB Electrification Canada’s purchase of Bel Products, an enclosure manufacturer.

#4. Electrical product pricing probably hasn’t seen the last of the impact of tariffs

Electrical product prices are reasonably tolerable right now. But lingering uncertainties remain over which products will be affected by higher tariff rates; product areas are still seeing double-digit year-over-year increases. According to the latest Electrical Price Index published monthly by Electrical Marketing newsletter at www.electricalmarketing.com, prices for Switchgear (+11.6%); Fuses (+10.6%); Motors (+9.6%); Panelboards & Switches (+9.1%); Industrial Controls (+8.8%); and Circuit Breakers (+8.7%); are up the most on a year-over-year basis through Sept. 2025.

#5. Data centers dominate the construction market

Without the year-over-year double-digit increase we have seen data center construction over the past year, the 2025 nonresidential construction market would really be limping along. Distributors, reps, and manufacturer respondents to the quarterly survey published by Electrical Wholesaling and Vertical Research Partners (VRP), Stamford, Conn., an equity research firm, believe data center construction will continue at its rapid pace into the new year. “Data centers remain the primary driver of activity, with hyperscale demand notably robust and no signs of a slowdown,” said Nick Lipinski a VRP equity analyst and vice president. “Outside of data centers, the industrial and construction demand environment remains relatively subdued.”

#6. NEMRA’s Lighting Division: An idea whose time has definitely come

The success of the launch of the National Electrical Manufacturers Representatives Association’s new Lighting Division is really impressive, with more than150 companies signing on this year. Jeff Bristol (right above), who heads up the division as its vice president; Jim Johnson (left above), NEMRA’s president and CEO; and the NEMRA staff should all be applauded for their efforts.

In addition to the launch, NEMRA developed its Lighting Stepped Educational Curriculum (SEC) with Illuminating Engineering Society so members can building lighting and controls competencies across all experience levels and will be hosting the NEMRA Lighting Summit Oct. 15-17, 2026 in Dallas, TX.

The timing for the launch of NEMRA Division comes at an important time in the lighting industry. New LED and control lighting technology has transformed the lighting business with new product providers, new roles for traditional lighting manufacturers and changing channels to markets. The lighting trade show and conference world has also changed dramatically with the re-launch of LightFair in 2027 by its new owners as a lighting show with a major focus on building systems and the growing popularity of the LEDucation trade show and conference in New York, which has quite possibly become the top U.S.-based lighting event.

#7. NEMA-NECA-NAED-NEMRA top execs explore the potential of joint synergies

During 2025, the heads of the electrical market’s largest trade associations – the National Electrical Manufacturers Association (NEMA); National Electrical Contractors Association (NECA); National Association of Electrical Distributors (NAED); and National Association of Manufacturers Representatives Association (NEMRA) – continued their quest to find common ground with market drivers that affect the entire electrical channel, including the opportunities in electrification and revitalization of the electrical grid; servicing the data center market; training the electrical workforce in these areas; as well as trade and legislative issues.

NEMA’s Debra Phillips, NECA’s David Long, NEMRA’s Jim Johnson and NAED’s Wes Smith and their associations’ staffs are doing an admirable job for their constituents in these efforts.

#8. AI is starting to take root in the electrical market

Artificial intelligence, or a more rudimentary form of what used to be called “machine learning” has been used in the electrical market for some time, mostly in the areas of pricing or suggested add-on products for digital storefront sales. But over the past year, we have seen more companies use it internally to also fine-tune inventory management, polish marketing programs, route management and to help contractors order online, check order status and assist in other areas of procurement. Sean Grasby, Wesco’s senior VP & general manager - U.S. Construction and Wesco Energy Solutions discussed how his company is using AI internally and for customers in EW’s most recent Executive Insights podcast.

It will be fascinating to see how the industry harnesses the power of AI over the next few years.

#9. Electric vehicle market sputters in the United States as federal rebates evaporate

The overall climate in the U.S. EV market is not quite what it was a few short years ago when the Biden Administration was actively promoting all sorts of financial incentives for EVs. Since the federal tax credits for electric vehicles (up to $7,500 for a new EV and $4,000 for a used EV) were curtailed by the Trump Administration on Sept. 30, EV sales have dropped precipitously in the United States. While there’s still opportunities with EV charging stations, the overall market has cycled down.

Some auto manufacturers are re-calibrating their EV investments to focus more on hybrids. The most recent example is the announcement by Ford to shift its emphasis to hybrid vehicles and to discontinue its all-electric Ford 150 Lightning pickup. Auto industry observers believe over that the long haul the U.S. market for EVs will grow, although at a much slower rate than had been anticipated a few years back. Much of that growth seems like it will depend on if auto manufacturers can develop a reasonably priced EV under $30,000 that catches the attention of consumers.

One lesson auto manufacturers may have learned from the challenges of their EV efforts is that government efforts to stimulate consumer demand with financial incentives only go so far. Consumers are glad to take any rebate or other financial incentives, but they make their purchases based on perceived value and quality for the price.

#10. Baby Boomers retirements changing the face of the industry

Keeping track of all the Baby Boomer execs in the electrical market over the past few months is hard to do. This wave of retirements part of a well-known and widespread demographic trends sweeping the nation, as the largest age cohort after Millennials reaches retirement age. It's a bittersweet moment because of how interwoven into the industry’s fabric Baby Boomers have been over the last few decades, but we wish them all well as they enter the next chapter of their lives.

Their retirement opens up new opportunities for a new generation of workers who bring a whole new set of unique skills. Many of them are digital natives who grew up with cellphones, tablets, social media and the internet, and it’s exciting to see how they are applying their technological knowledge to digital storefronts, artificial intelligence and new ways to work with vendors and customers.

About the Author

Jim Lucy

Editor-in-Chief

Over the past 40-plus years, hundreds of Jim’s articles have been published in Electrical Wholesaling and Electrical Marketing newsletter on topics such as the impact of new competitors on the electrical market’s channels of distribution, energy-efficient lighting and renewables, and local market economics. In addition to his published work, Jim regularly gives presentations on these topics to C-suite executives, industry groups and investment analysts.

He recently launched a new subscription-based data product for Electrical Marketing that offers electrical sales potential estimates and related market data for more than 300 metropolitan areas, and in 1999 he published his first book, “The Electrical Marketer’s Survival Guide” for electrical industry executives looking for an overview of key market trends.

While managing Electrical Wholesaling’s editorial operations, Jim and the publication’s staff won several Jesse H. Neal awards for editorial excellence, the highest honor in the business press, and numerous national and regional awards from the American Society of Business Press Editors. He has a master’s degree in Communications and a bachelor’s degree in Journalism from Glassboro State College, Glassboro, N.J. (now Rowan University).