A Closer Look at EW’s Electrical Pyramid - Specialists and Hybrids

Electrical Wholesaling provided an updated Electrical Pyramid and related analysis in the July issue and in the August issue we focused on product specialists. In this article, we will take a look at the distributors that supply a package of products and installation services and wrap up our discussion of hybrid distributors.

SERVICE/PRODUCT SPECIALISTS

Companies in service businesses like motor repair, demand-side management or lighting maintenance populate another growing channel to market for electrical goods. In motor repair, for example, as the cost to repair small motors can be prohibitive, the companies that used to just fix them started selling them, too. Now many are also getting into drives and controls, as motor repair becomes a smaller portion of their business. Some energy-service companies are acquiring, stocking and selling the products they recommend in their energy-saving analyses of customers’ facilities. And high-tech distributors have for years been doing quite a bit more than just selling products.

High-tech specialists. The technological shockwaves rocking computer hardware manufacturers, where yesterday’s breakthrough product is tomorrow’s dinosaur, are felt in the close-knit high-tech industrial market, too. Take the programmable logic controller (PLC), which several decades ago was the product most responsible for bringing the power of computers to individual manufacturing processes on the factory floor. It didn’t take long for the PLC to go from the leading edge of technology to a stepchild overshadowed by the brainpower of the custom application software that tells these devices what to do.

Today, we have the “Internet of Things,” and all that may or may not mean to high-tech distributors. Automation distributors like to joke that the shelf life of their inventory will always be comparable to that of fresh vegetables. You may be able to say that about some of the various specialized software packages controlling all of the industrial devices on the factory floor, because distributors that play in this niche must have more than a working knowledge of these programs, too.

As the industrial automation market evolves, so do the purchasing habits of customers, who, to the frustration of distributors, are shopping their quotations for complex packages of products, services and training outside the distribution channel much more than ever with online options such as www.automationdirect.com.

The industrial automation market is much larger than you might think. For those of us who spend most of our time in the electrical wholesaling industry, it’s easy to make the mistake of thinking that it’s only as big as the companies who are distributors of industrial automation products from Rockwell Automation ABB, Eaton, Siemens or Schneider. The reality is that many distributors and reps who are major players in this market space carry all sorts of different products from manufacturers who don’t have the same visibility in the mainstream electrical market as the companies just mentioned.

Product focus. Industrial automation products including but not limited to PLCs, industrial sensors, variable-speed drives, machine vision systems, wireless communications equipment, operator-interface panels, enclosures and related automation products.

Primary customers. Industrials involved in virtually any manufacturing process, original-equipment manufacturers (OEMs) and machine-tool builders.

National association. Association for High Technology Distribution (AHTD), Waukesha, Wis., 262-696-3645, www.ahtd.org.

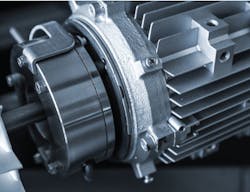

Motor specialists. Many of these specialty distributors got their start as motor repair shops, but because in many cases it became more economical for customers to buy new motors rather than repair old ones they expanded into the sales of drives and motor controls. Because motors account for a healthy chunk of the electrical use in the typical commercial/industrial building these distributors, there’s a whole host of federal, state and local financial incentives, as well as utility rebates, available for end users. Motor distributors must be adept at guiding customers through the details of the sometimes convoluted incentive application process.

Product focus. Motors, motor parts, starters, drives and related industrial controls.

Primary customers. Companies of all sizes in the industrial and commercial markets.

National association. Electrical Apparatus Service Association (EASA), St. Louis, Mo., 314-993-2220, www.easa.org. EASA is an international trade organization of more than 1,900 electromechanical sales and service firms in 62 countries.

Voice/Data/Video (VDV) specialists. No two distributors are exactly alike in the VDV arena. The players include large distributors that have been in the market for years like Anixter, Graybar, WESCO (with a big lift from its Communications Supply Corp. business unit); wire specialists operating as part manufacturer; distributors building small quantities of cable/connector assemblies; regional companies that are subsidiaries or separate business units of full-line electrical distributors; and relatively small companies that go national with toll-free telephone numbers and next-day delivery.

Product focus. Wire and cable, connectors and other networking equipment for computer, telephone and video installations.

Primary customers. Any building with computer, telephone or video systems. Largest customers include computer-intensive service companies, hospitals, universities and industrial plants.

National association. BICSI, Tampa, Fla. (www.bicsi.org) provides certification training, industry standards and networking opportunities for installers, designers, manufacturers, distributors and other interested parties in the VDV industry. BICSI’s 23,000 members are in more than 100 countries.

Lighting maintenance specialists. Don’t make the mistake of thinking that these firms just drive around in their bucket trucks repairing and maintaining signs, parking lots lighting and other exterior lighting systems. They also go after retrofit and maintenance contracts from a broad range of retail, commercial and institutional customers. While most of these companies are smaller firms with roots in the contracting end of the business, some full-line distributors, including Border States Electric, Fargo, N.D., and Graybar Electric Co., St. Louis, go after the business, too. Another big player in this niche is Facility Solutions Group (FSG) Austin, Texas, which came to this market from the contracting end of the business.

National association. International Association of Lighting Management Companies (NALMCO), Ankeny, Iowa, (515) 243-2360, www.nalmco.org.

Energy-services companies (ESCOs). ESCOs offer a sophisticated package of design, technical assistance, audit, financing and, in some cases, installation services in the energy market. Relatively few of them function as distributors in the same sense as the other product specialists mentioned here. Their primary interests tend to be design and installation, not supply. If ESCOs use subcontractors for installations, they often leave the purchasing to the discretion of these companies. However, as electrical distributors who have ESCOs in their markets will tell you, ESCOs have a lot to say about which products are used in the systems they install.

ESCOs have played a significant role in the electrical market the past 25 years. They started out in markets with big utility-rebate programs because they helped customers get the most out of them. When ESCOs engage in what is called “performance contracting,” they help a customer finance the products, and the customer then pays them back based on the electrical energy-use savings it gets from these more efficient products.

Going back a few years, public utilities bought a whole bunch of ESCOs to handle the design and installation of energy-efficient electrical systems, sometimes forming a new channel to the market competing with the more traditional distributor-contractor relationship.

The electrical distributors with the best grip on the energy market see ESCOs as customers, not competitors, because they provide them with a reliable, full package of energy-efficient electrical products for their design and installation projects. As this channel evolves, though, electrical distributors may see more ESCOs buying direct from manufacturers, particularly with those companies owned by utilities. Utilities often buy direct because they purchase electrical products in huge quantities, and it’s possible that they would continue this practice with the products that their ESCOs install.

Product focus. Relatively few ESCOs show interest in stocking equipment, but the ones that do carry the full range of energy-efficient products: energy-efficient lighting fixtures, lamps, reflectors, variable-speed drives and other types of energy-efficient products.

Primary customers. Retail, commercial, industrial, institutional and government facilities.

Number of locations. An estimated 100 to 200 companies.

National association. National Association of Energy Service Companies (NAESCO), Washington, D.C., 202-822-0950, www.naesco.org.

HYBRID DISTRIBUTORS

In some ways, hybrid distributors attract more attention as an alternate channel to the electrical market than any other level of EW’s Electrical Pyramid. That’s due in part to the size of the companies on this level — Anixter, W.W. Grainger, HD Supply, and Fastenal Inc. — but even more so because of some of the unique services or operating characteristics they offer. For instance, when folks think Grainger, they often think first about its best-in-class website. And Fastenal sticks out because of its massive branch network of over 2,600 branches the investment it made in thousands of industrial vending machines in factories. We won’t get into extensive detail on these companies in this article because we previously discussed them in Electrical Wholesaling’s Top 200 in the June issue, where we published brief profiles on three of these distributors, and in the July issue, where we published the 2015 Electrical Pyramid. These articles are available at www.ewweb.com.

Since that time, some interesting news broke on this level of EW’s Pyramid with Anixter’s purchase of HD Supply’s Power Solutions business unit, a move that immediately makes Anixter the largest distributor of utility supplies in North America and dramatically broadens its product offering to a more full-line focus.

Some EW readers or industry observers don’t consider these hybrid distributors “real” electrical distributors and question the magazine’s editors about why we rank them in the Top 200 listing. But we think the broadest possible definition of a distributor of electrical supplies most accurately reflects the realities of today’s marketplace.

Even though they are often direct competitors to full-line electrical distributors, these companies — whether they be product specialists, hybrid distributors, online merchants, or a yet-to-be-determined mix of all these together — can each in their own way satisfy vendors’ local channel needs. It’s important these full-line electrical distributors know how these competitors operate and when possible borrow some of their ideas.

About the Author

Jim Lucy

Editor-in-Chief of Electrical Wholesaling and Electrical Marketing

Jim Lucy has been wandering through the electrical market for more than 40 years, most of the time as an editor for Electrical Wholesaling and Electrical Marketing newsletter, and as a contributing writer for EC&M magazine During that time he and the editorial team for the publications have won numerous national awards for their coverage of the electrical business. He showed an early interest in electricity, when as a youth he had an idea for a hot dog cooker. Unfortunately, the first crude prototype malfunctioned and the arc nearly blew him out of his parents' basement.

Before becoming an editor for Electrical Wholesaling and Electrical Marketing, he earned a BA degree in journalism and a MA in communications from Glassboro State College, Glassboro, NJ., which is formerly best known as the site of the 1967 summit meeting between President Lyndon Johnson and Russian Premier Aleksei Nikolayevich Kosygin, and now best known as the New Jersey state college that changed its name in 1992 to Rowan University because of a generous $100 million donation by N.J. zillionaire industrialist Henry Rowan. Jim is a Brooklyn-born Jersey Guy happily transplanted with his wife and three sons in the fertile plains of Kansas for the past 30 years.