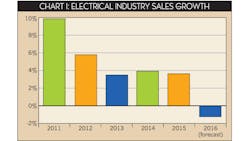

The electrical industry is coming out of a down year, something it hasn’t experienced in seven years. And that leads me to wonder if this industry doesn’t have the “seven year itch.” It was exactly seven years ago that electrical industry sales were down nearly 24% as we struggled to climb out of the Great Recession.

To add to the mystery of seven years, the previous industry downturn was seven years before that. In 2002, electrical industry sales were down 8.8%.

So in the course of the last 14 years sales declined three times, in 2002, 2009 and now 2016.

The average annual growth over the past 14 years was 3.6%. The crucial question is can you make any money if your sales hypothetically grew at that rate every year?

If the answer is yes, then you have done well over the past five years because in each of the past five years industry sales grew faster than the average annual growth of the last 14 years.

In addition, we are forecasting electrical industry sales to advance better than 4% in each year between 2017 and 2020. If you can make money with sales growth of 3.6%, then with other things equal, you should make money over the next five years with the projected sales growth.

If you are Mr. Average Electrical Distributor that’s the kind of performance you can expect in the long run (five years is long run).

But I don’t think there is or ever was a Mr. Average Electrical Distributor. The average is a composite of a diversity of electrical distributors, operating in widely diverse markets and market segments.

At the top, our outlook for next year is for industry sales to advance 4.7% from the 2016 level. Not coincidentally, the Electrical Wholesaling team is forecasting industry sales to grow 3.1% next year, after gaining 3.7% this year, compared to our minus 1.3% for 2016.

But as they say, the devil is in the details and I think it’s important to peel back the top layer and look at the details.

Whether industry sales are up 3.1% or 4.7% is not crucial, because a difference of 1.6% is within the margin of error (although for your business sales the difference between 3.1% and 4.7% can make a difference in the bottom line). Remember this is an industry forecast, with no bottom line consequences, but the bottom line of your business does have consequences. And there is always a margin of error in an industry forecast. For your business you do not have the luxury of a margin of error, especially for the bottom line. My question, again, is can you make any money if your sales grow 3.1%? How about 4.7%?

If not, what kind of sales growth do you need to achieve if your business is going to be profitable next year?

Here are the details that I think are crucial for electrical distributors. For this year total industry sales will be down 1.3%. But that’s not the most important part of the story. What is important is why and where. At the national level distributor-served contractor sales were down 0.4%. But, distributor-served industrial sales were down 3.3%. That difference is huge. It’s all about managing and allocating resources. If you are not tracking your sales segments how can you direct your people and evaluate their performance?

The point is there is a significant difference between the growth in the distributor-served contractor market, the distributor-served industrial market and total industry sales. The difference last year was nearly four percentage points. And the difference next year is expected to be more than two points. Clearly, these margins can make a difference in your business revenue and profitability.

The emphasis for electrical distributors is where do you do business? If you are primarily in the contractor market your sales will be stronger. If you are primarily in the industrial market expect weakness.

If you think our forecast is too robust, take it down, but the crucial thing is the emphasis on the variance between the contractor market and the industrial market does not change.

We continue to see relative strength in the distributor-served contractor market, and relative weakness in the distributor-served industrial market. Your total market penetration, in the first instance, is how well you penetrate the key market segments. In that case your total market share will take care of itself.

About the Author

Herm Isenstein

Herm passed away in Sept. 2019 at the age of 86 from brain cancer. He was a good friend to the editors on the staff of Electrical Wholesaling and a prolific writer for the magazine for 15 years.

During his 30-plus years in the electrical industry, Herm Isenstein was the premier economist in the electrical wholesaling industry If you have any questions about DISC's subscription-based data services, contact Chris Sokoll, DISC's president at at 346-339-7528.